Will a Fed Rate Cut Save the Housing Market?

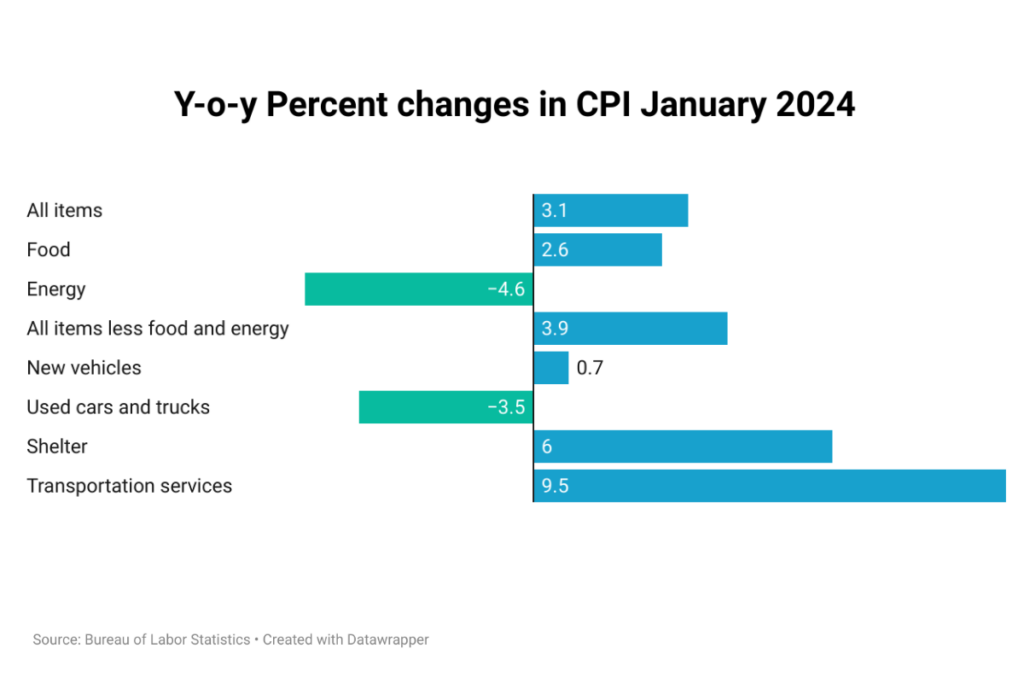

Soaring home prices and high mortgage rates keep the brakes on homeownership dreams in 2024. A potential Fed rate cut offers limited hope, as locked-in sellers restrict inventory growth. The housing market’s future depends on the Fed, economic data, and inventory levels, with a quick and significant affordability improvement unlikely.

Will a Fed Rate Cut Save the Housing Market? Read More »