At its December 2023 meeting, the Federal Reserve had indicated that the policy rate was at or near its peak and FOMC projections called for three quarter-point cuts in 2024. This was based on promising macroeconomic data, but the Fed had cautioned that while inflation was trending lower it remained elevated above the target 2% level. The current challenge for the Federal Reserve lies in navigating a nuanced balance. Acting too swiftly poses the risk of reigniting inflationary pressures, while moving too cautiously in rate cuts raises the prospect of the economy grappling with the weight of elevated interest rates and the potential for substantial job losses.

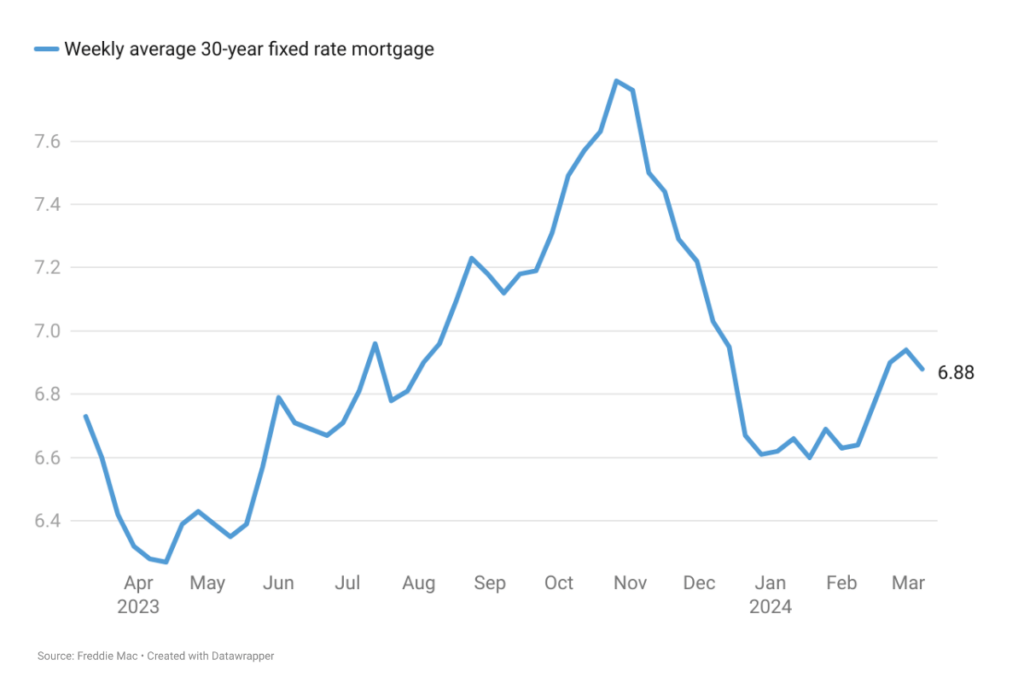

After the December 2023 meeting, many investors and analysts had predicted six rate cuts and rapidly declining mortgage rates that would not only ease supply but bring back many homebuyers to the market and that housing affordability would improve. Many had anticipated a rate cut as early as March 2024. After the Fed’s January 2024 meeting, the odds of a March rate cut have declined significantly due to data showing continuing strength in the U.S. economy. The 30-year fixed rate mortgage has inched up from 6.62% at the beginning of January 2024 to 6.88% on March 7th, 2024 (Freddie Mac®). As a result, potential home buyers are staying on the sidelines, waiting for a more affordable interest rate regime.

February’s inflation reading of 3.2% was slightly higher than 3.1% in January 2024. With inflation data continuing to come in above the Fed’s target level, unemployment remaining below 4%, wages increasing, and the economy posting strong growth, the Federal Reserve is in a wait and watch position, awaiting signals from the economy before it is convinced that things are moving in the right direction. The market has pushed back rate cut expectations from March to June, while there are a few who are of the opinion that the Fed may not cut rates this year at all. While mortgage rates are not directly influenced by the Federal Funds Rate (FFR), they are indirectly influenced by it. The FFR influences the broader interest rate environment, impacting the yields on Treasury bonds and subsequently affecting the rates at which mortgage lenders offer fixed-rate mortgages to consumers.

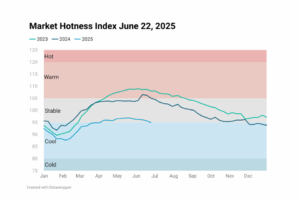

Veros expects that the Federal Reserve will cut rates by a maximum of 50 basis points during 2024 and mortgage rates will end the year 2024 at around the 6.6% mark. What this means for the housing market is that supply will remain low due to the rate lock-in effect. The anticipated dip in mortgage rates is unlikely to loosen the grip on the housing market. Since most homeowners (around 80%) currently enjoy rates under 5%, they would face a disadvantage selling and buying with potentially higher rates. Demand will be there but will be constrained because home buyers will remain challenged by affordability concerns, and new construction will continue to face high input and borrowing costs. Overall, home buyers will chase the few properties up for sale, so that prices will continue to rise, albeit at single digit levels.