The uncertainty surrounding mortgage rates and home prices prompts critical questions for those contemplating homeownership. Will mortgage rates experience a rise or fall, and if so, to what extent? What trajectory will home prices follow, and how might they counteract potential gains from lower mortgage rates?

Prospective homebuyers are finding themselves pondering the opportune moment to enter the market. Veros’ December 2023 projections for 2024 indicate a low single-digit increase in home prices, albeit with significant regional variations. While certain areas, particularly in the northeast and Midwest, may witness high single-digit gains, others, such as some counties in Texas and Idaho, may experience a decline.

While currently mortgage rates are hovering at around 6.6%, the consensus among experts leans towards a decrease by year-end to the low-6 percent range, with expectations tied to potential Federal Reserve rate cuts. Veros, specifically, foresees a decline in mortgage rates to the mid-6 percent range. Lower mortgage rates will translate into reduced monthly payments, providing immediate relief to homeowners’ budgets. However, in many regions, rising home prices will more than offset any expected gains from a decline in rates.

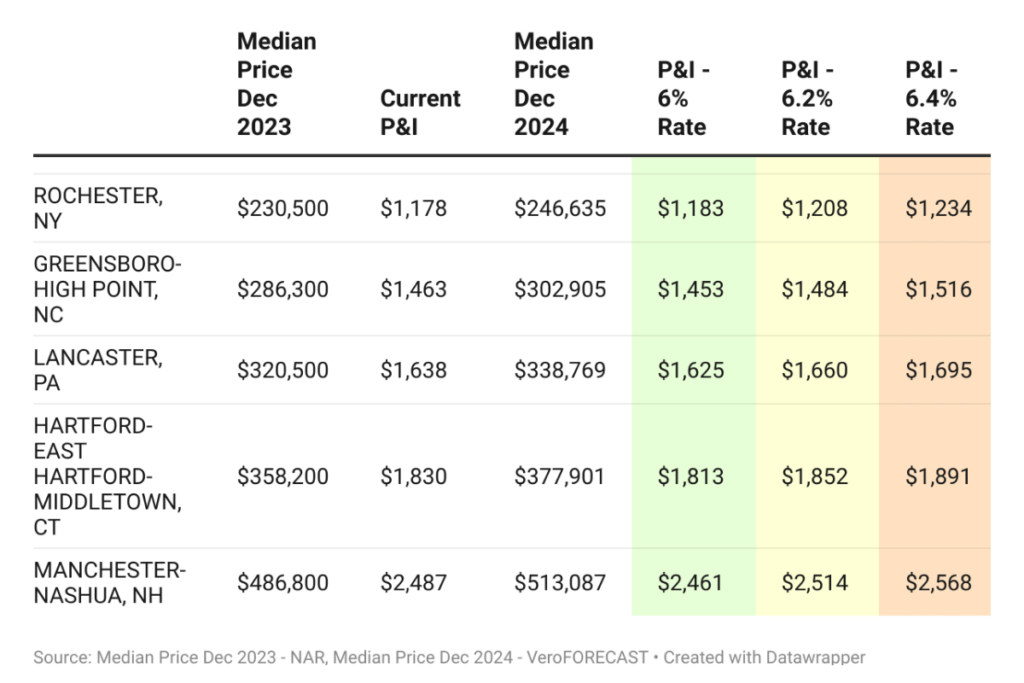

The following table highlights the top 5 metropolitan areas where opting for an immediate purchase may prove a more strategic approach than delaying, given that the effect of rising prices on monthly mortgage payments outweighs the impact of declining rates. Rochester, NY, is one of the hottest housing markets in the country and is forecasted to grow at 7% (Dec 2023 VeroFORECASTSM during 2024. Other markets poised for significant price growth include Greensboro-High Point, NC; Lancaster, PA; Hartford-East Hartford-Middletown, CT; and Manchester-Nashua, NH. Notably, several additional metros, particularly in the northeast and Midwest, demonstrate a trend where escalating prices outweigh potential gains from lower rates. In these areas, a decline in rates to 6% or below would effectively counterbalance the surge in prices. For example, the median house price in Rochester, NY in December 2023 was $230,500. At a rate of 6.6% and excluding all other costs, the monthly mortgage principal and interest payment amounts to $1,178. Assuming prices rise by 7%, the mortgage rate would have to decline to 6% or lower to counter the effect of rise in prices.

However, it is crucial to acknowledge that as rates decrease and more buyers enter the market, heightened competition is likely to contribute to a further escalation in prices. The nation continues to face a housing shortage that has kept prices elevated despite the rise in mortgage rates in the second half of 2022 and 2023. Supply is a crucial part of the housing market and while lower rates might open up supply a bit, they will also push up demand.

At the end of the spectrum are regions of the country where home prices are expected to decline through 2024 according to the December 2023 VeroFORECAST. These areas may present enticing opportunities for prospective homebuyers to consider a delayed purchase, capitalizing on both reduced property prices and lower mortgage rates. Among these markets are St. George, UT; Austin-Round Rock-Georgetown, TX; Boise City, ID; Lake Charles, LA; and Las Vegas-Henderson-Paradise, NV.

The decision to embark on the journey of homeownership, however, remains a nuanced one, contingent on a myriad of considerations. Factors such as personal financial standing, long-term objectives, and the peculiarities of the local real estate market will necessitate careful evaluation.