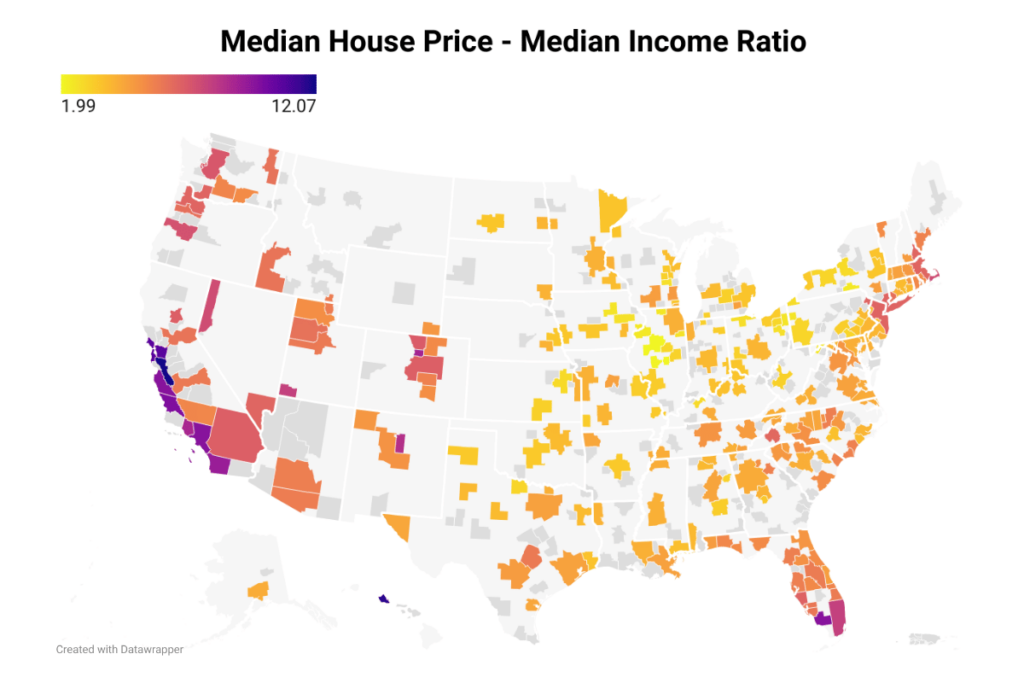

In the dynamic landscape of the real estate market, the patterns of homebuyer interest are undergoing a transformation. A noteworthy shift is being observed as buyers veer away from the traditionally popular West and South regions, redirecting their attention to the affordability haven offered by the Northeast and Midwest. This shift is fueled by the stark reality of nationwide home prices skyrocketing by almost 49% from January 2020 to November 2023, coupled with mortgage rates consistently exceeding 6% since the third quarter of 2022. Let’s explore this evolving trend further by examining the median price-to-median household income ratio in 2022, a key indicator of housing affordability, depicted in the map below.

The disparities in housing affordability become evident when scrutinizing the price-to-income ratios across different regions. Western states, including California, Washington, Oregon, Idaho, Utah, and Colorado, stand out with significantly higher price-to-income ratios. Southern Florida also emerges with metros exhibiting elevated price-to-income ratios.

In response to the escalating costs, especially in states with higher price-to-income ratios, homebuyers—particularly first-time buyers—are strategically adjusting their focus. The quest for more affordable options is drawing them toward the Northeast and Midwest, where the price-to-income ratios are comparatively lower. This shift underscores the growing importance of housing affordability as a primary factor influencing homebuyer decisions.