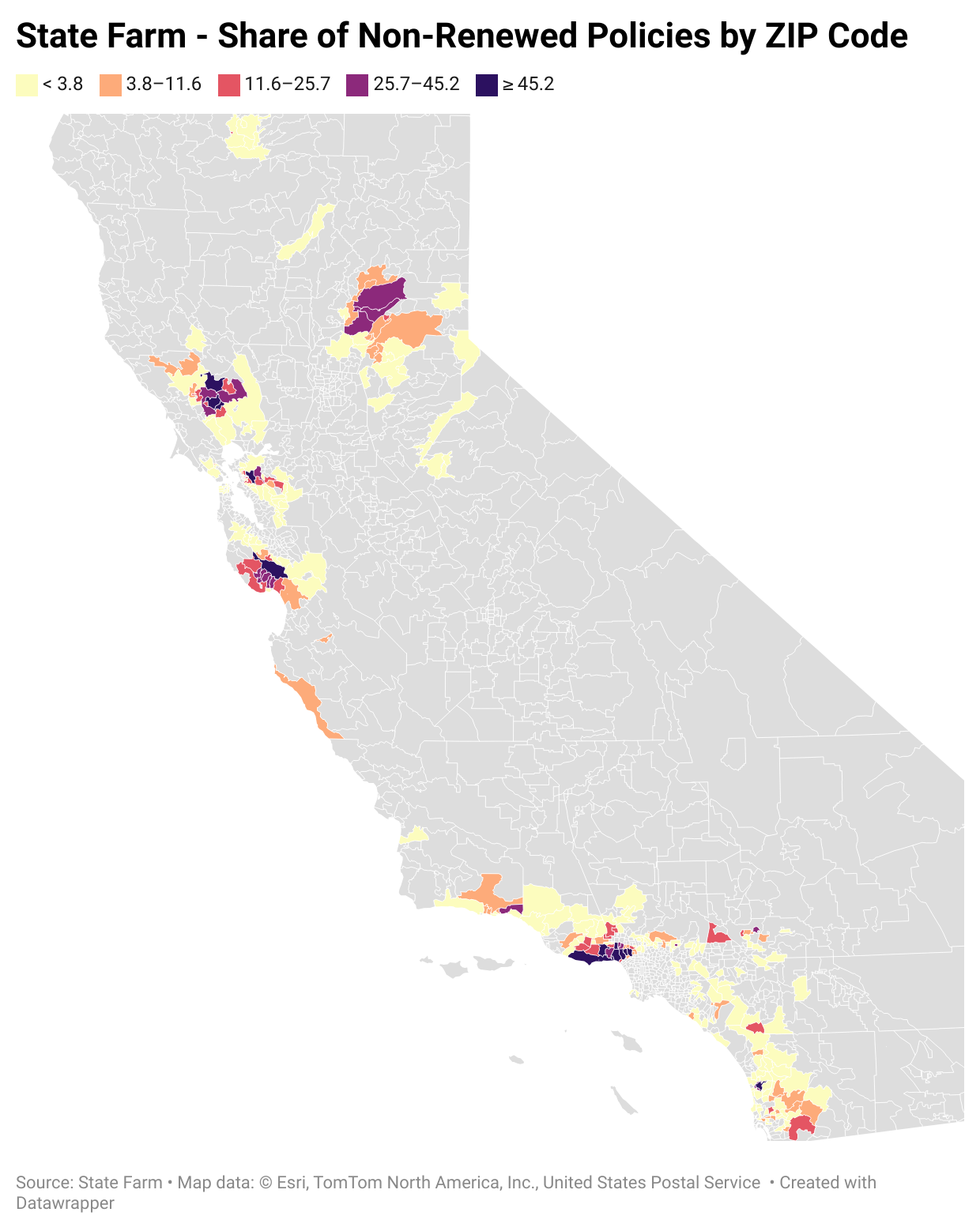

Earlier this year, State Farm General Insurance Company announced it wouldn’t renew 72,000 property insurance policies in California. Many of these policies cover areas at high risk of wildfires, earthquakes, or have densely populated homes. Allstate also won’t sell new homeowner insurance, and other companies are following suit. The main reasons cited are wildfires, costly home repairs, and higher reinsurance premiums. California ranks second after Texas for the number of wildfires in 2022. According to data from the Insurance Information Institute (Triple-I), there were 7,884 fires in California in 2022 that burned down more 300,000 acres. Furthermore, more than 1.2 million homes in California are at risk for extreme wildfires.

For instance, State Farm won’t renew nearly 70% of its policies in ZIP code 90272 (Pacific Palisades), 67% in ZIP code 90077 (Bel Air), 65% in ZIP code 95033 (Los Gatos), 62% in ZIP code 90049 (Brentwood), 55% in ZIP code 94563 (Orinda), and 51% in ZIP code 92067 (Rancho Santa Fe). What does this mean for potential home buyers and sellers? How will it impact home prices in these neighborhoods?

One significant impact could be reduced buyer demand. Homeowners insurance is usually required to get a mortgage. If fewer companies offer coverage or if policies become much pricier, it might discourage some buyers, lowering home prices. The impact might vary across the state. Areas at higher wildfire risk or less appealing to insurers might see bigger declines in demand and possibly larger price drops.

Existing homeowners might struggle to renew or find new policies if their company leaves California. This could lead to higher costs if they find other insurance, which could be much pricier. Homes without insurance might be less attractive to buyers, affecting selling prices and timelines.

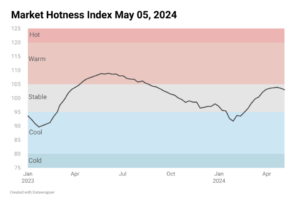

In the long run, this situation could affect California’s housing market. Prices might slow down or drop slightly, depending on how serious the insurance issue is. But the housing market is complex, influenced by many factors. While declining insurance availability is concerning, it’s hard to predict its exact impact on prices. The government might step in to help, like making new regulations or offering incentives to insurers, which could ease the burden on homeowners and the market.

Also, the price impact might depend on how easy and cheap it is to get other insurance. Areas with good job markets and fewer homes might still have demand, lessening price drops. High-priced neighborhoods might not feel it if buyers aren’t worried about higher insurance costs or don’t need a mortgage.

Overall, the reduced availability of homeowners insurance in California presents a challenging scenario to the housing market. It could lead to reduced buyer demand, higher costs for existing homeowners, and potentially a correction in housing prices, although the exact impact remains uncertain.