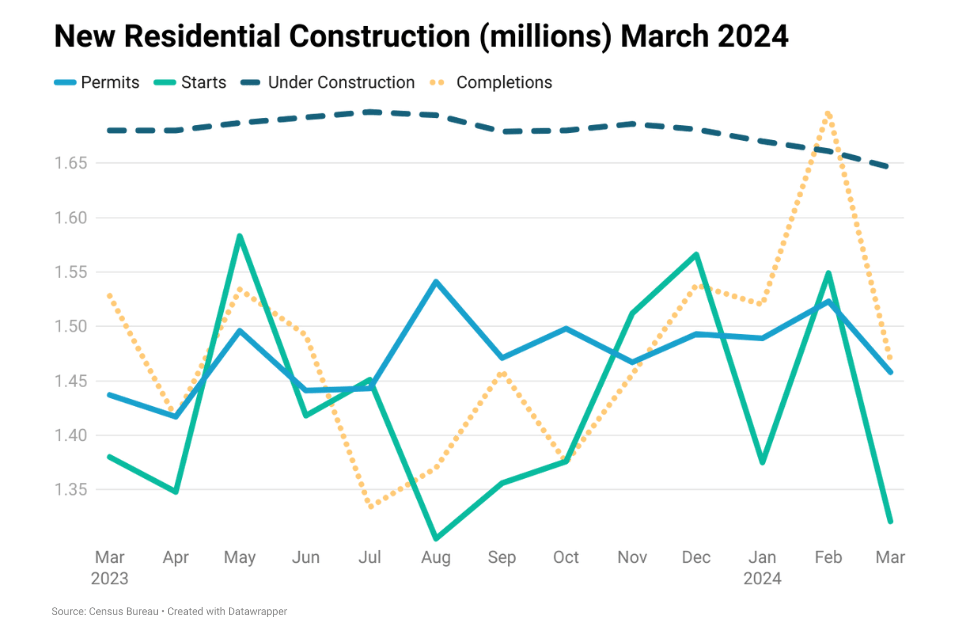

Higher for longer mortgage rates are impacting not only home buyers but also appear to be influencing home construction. Recently released data by the Census Bureau shows that housing starts fell 14.7% on a m-o-m basis in March 2024 to 1.321 million units and by 4.3% on an annual basis. While the monthly decline was almost similar for the single-family segment at 12.4%, there was an annual gain of 21.2% to 1.022 million units. Moreover, there was an annual decline in housing starts of 56.8% in the Northeast and 11% in the South. However, there was an increase of 18% in the Midwest and a substantial 48.1% surge in the West.

While building permits, indicating future construction activity, saw a modest 1.5% annual uptick to 1.458 million units, permits for single-family homes surged by 17.4% annually. Permits for single-family homes increased by 17.4% on an annual basis. However, it should be noted that housing starts and permits are volatile series.

The number of units under construction has steadily decreased since November 2023, marking a 2.0% annual decline to 1.646 million units in March 2024. Although the Northeast, South, and Midwest experienced declines, the West saw an increase in housing units under construction.

Builders are adjusting to revised market expectations, with fewer anticipated rate cuts in 2024 compared to year-end projections in 2023. This adjustment has prompted some home buyers to step back from the market, thereby reducing demand. Builders are also facing headwinds in the form of higher borrowing, labor, and material costs. A decline in construction activity exacerbates the existing shortage of housing units, further propelling prices upward. As such, the combination of limited existing home supply and a slowdown in new home construction is likely to perpetuate the upward trajectory of housing prices.