As 2023 drew to a close, there was a buzz in the housing market that homes would become more affordable in 2024 with the expected decrease in mortgage rates. Many forecasted that the Federal Reserve would implement 5 to 6 rate cuts throughout 2024, which was projected to significantly reduce mortgage rates and enhance housing affordability. However, contrary to expectations, this scenario is not unfolding in 2024. There is now uncertainty regarding whether the Fed will implement any rate cuts at all. It seems improbable that mortgage rates will dip below the current level in the near future, and there’s little indication of a decline in home prices either.

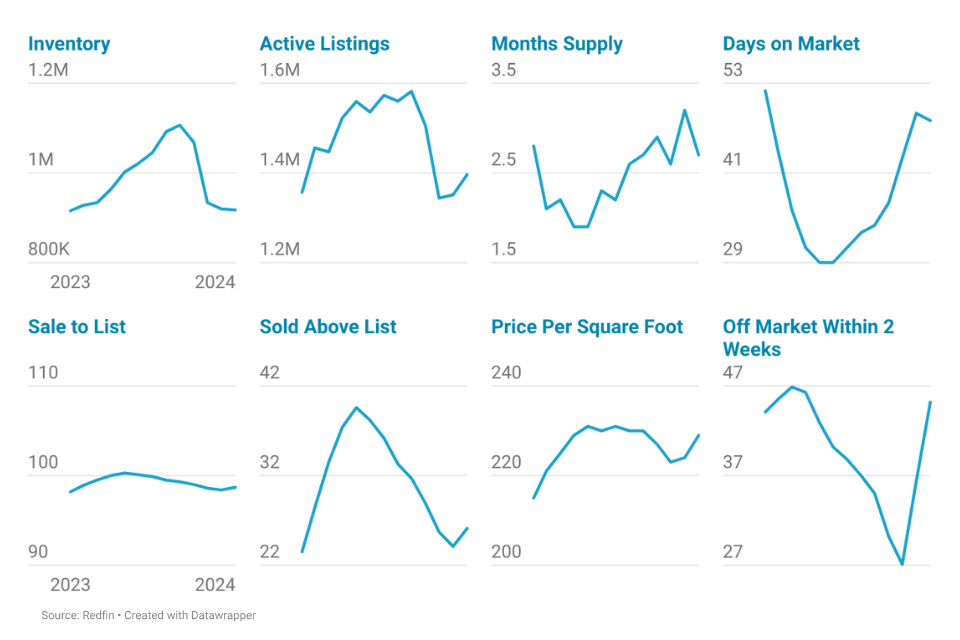

According to Redfin data, the supply side of the housing market saw a modest increase in nationwide inventory, with just 1,645 more homes available from February 2023 to February 2024, while the months’ supply decreased slightly from 2.8 to 2.7. A combination of factors is keeping existing homeowners from listing their properties, leading to a stagnant supply side of the market. While many hoped for falling rates in 2024, the reality is that rates have increased from 6.62% at the beginning of 2024 to 6.88% currently (April 12, 2024). This discourages homeowners with historically low mortgage rates from selling their homes because they would have to secure a new loan at a higher rate, making their monthly payments more expensive. Further, homeowners might be hesitant to sell due to the limited inventory. They might worry that they won’t be able to find a suitable new home themselves, especially if they need to move quickly. Institutional investors have become a significant factor in the housing market, buying up a sizable portion of available properties, particularly single-family homes. This further reduces the number of homes available for traditional homebuyers.

However, there are different groups of people who might still be selling homes despite the current market conditions with high prices and high rates – people who are looking to move to a larger or smaller home depending on their life stage; people who need to relocate for a job change might be more likely to sell their homes, even if the market isn’t ideal; some homeowners might need to sell due to financial reasons, such as job loss, divorce, or medical bills; and those that own their homes outright and are not impacted by the level of mortgage rates. It’s important to note that even though these groups might be selling, the overall number of sellers on the market is much lower than in a more balanced market.

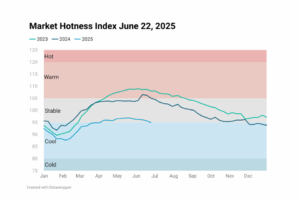

Despite high mortgage rates and prices, demand has remained strong, as indicated by a decrease in days on the market from 52 to 48, a rise in the sale-to-list ratio from 98.2% to 98.7%, and an increase in off-market sales within two weeks from 44.1% to 45.2%. With low inventory, buyers are still willing to compete for the limited options available, even at higher prices and interest rates. The current job market is healthy, with low unemployment. This means many potential buyers are financially secure and confident in their ability to afford a home, even with higher mortgage rates.

However, it is important to point out that while demand might appear strong, it’s possible that it’s not as robust as it seems. There is a hidden layer of buyers who are priced out due to rising costs. They might still be interested but simply unable to compete in the current market. Overall, the interplay of limited inventory, a strong job market, and the desire for homeownership are creating a situation where demand remains steady despite rising costs. Consequently, the price per square foot rose from $215 in February 2023 to $229 in February 2024. The Q1 2024 VeroFORECASTSM is projecting a 2.9% average nationwide increase in home prices over the next 12 months.

Looking forward, we anticipate a continuation of current trends. The likelihood of mortgage rates falling below the high-6% range appears slim, while home prices are expected to persist in their gradual ascent. This ongoing trajectory reinforces the persistent challenge of affordability, which remains a defining characteristic of our current housing market landscape.