Investors are buying up affordable homes in the United States, a lot of them. Redfin reported that investors bought up 26% of low-priced homes in the fourth quarter of 2023; this is the highest share of affordable homes that investors have bought at any time. Low priced homes are defined by Redfin as those situated in the lowest third of the local housing market in terms of sale prices. This statistic is especially important in an environment where housing affordability is poor given the high mortgage rates and home prices.

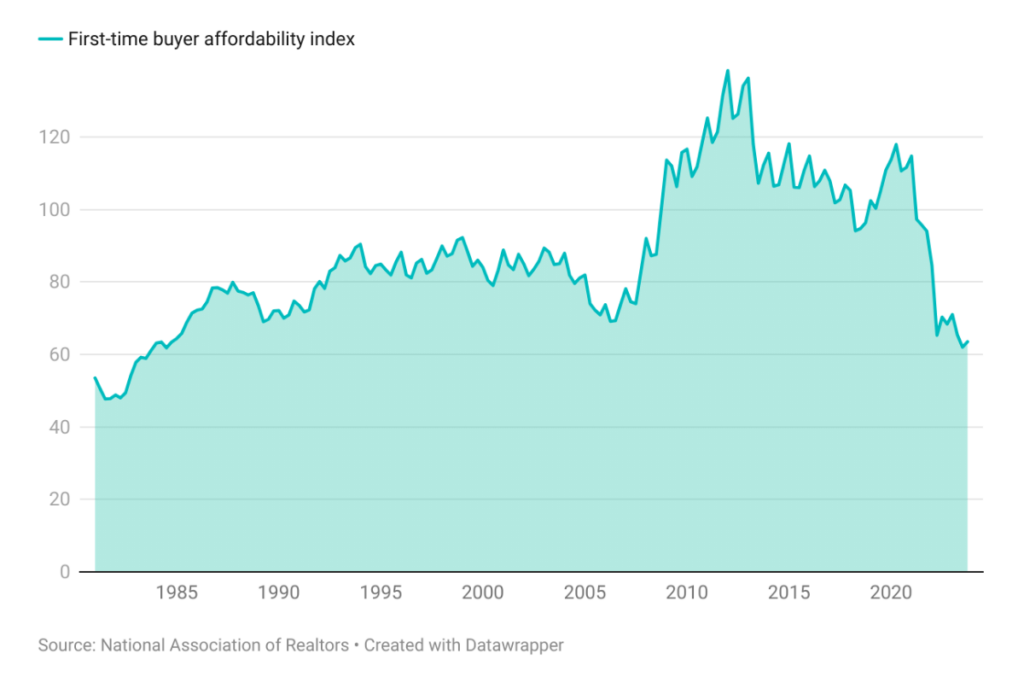

At 63.5 the housing affordability for a first-time buyer is at the lowest level since 1985. The value of the index is equal to 100 when median family income enables qualification for an 80% mortgage on a median-priced existing single-family home, according to the National Association of Realtors (NAR). An ascending index signals increased affordability for potential homebuyers.

In a landscape characterized by constrained housing supply and diminished affordability, prospective first-time homebuyers find themselves navigating heightened competition with investors for the limited pool of affordable or low priced homes available on the market. Notably, seven of the top 10 markets witnessing a substantial increase in the proportion of homes acquired by investors over the past year are situated in California—specifically, San Diego, Sacramento, Riverside, Anaheim, San Jose, Los Angeles, and Oakland (Redfin research). These metropolitan areas are associated with some of the lowest affordability index values nationwide. The remaining three markets experiencing a notable surge in investor activity are Chicago, IL; Portland, OR; and Warren, MI.

Investors are engaging in two primary strategies with these homes—either renovating and reselling them at a premium compared to the purchase price or opting to rent them out. Both scenarios carry the potential for elevated property values. In the first instance, where investors opt for property flipping, the resale price significantly exceeds the initial purchase cost. In the second scenario, renting out these homes contributes to a reduction in market supply, intensifying competition in an already constrained environment. This heightened competition, in turn, has the potential to drive up prices.