Media channels are currently abuzz with discussions surrounding baby boomers and homeownership, citing them as a key factor contributing to the constrained housing supply. Let’s take a deep dive and find out.

The Demographics

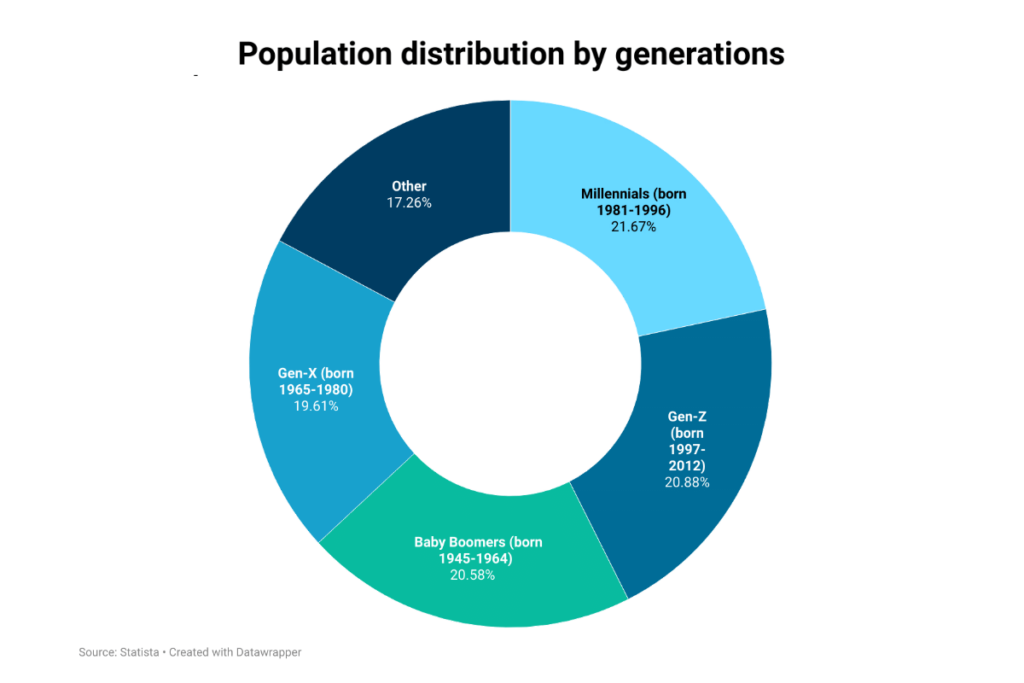

The Baby Boomer generation, born between 1946 and 1964, is a formidable force of approximately 73 million individuals. This cohort is currently witnessing around 10,000 members crossing the 65-year threshold daily, with the entirety of the generation expected to reach this milestone by 2030 (Census).

As Baby Boomers approach retirement, a pivotal moment in their lives, a common narrative unfolds. Typically, their children have either moved out or are on the brink of embarking on their own independent journeys. This phase of life prompts a significant transformation in household dynamics. As the younger generation establishes their own households, the once-unified family home now gives rise to two or more separate households. While this demographic-driven demand for housing increases, there are not enough homes to support this rising demand.

Which generation owns the most homes?

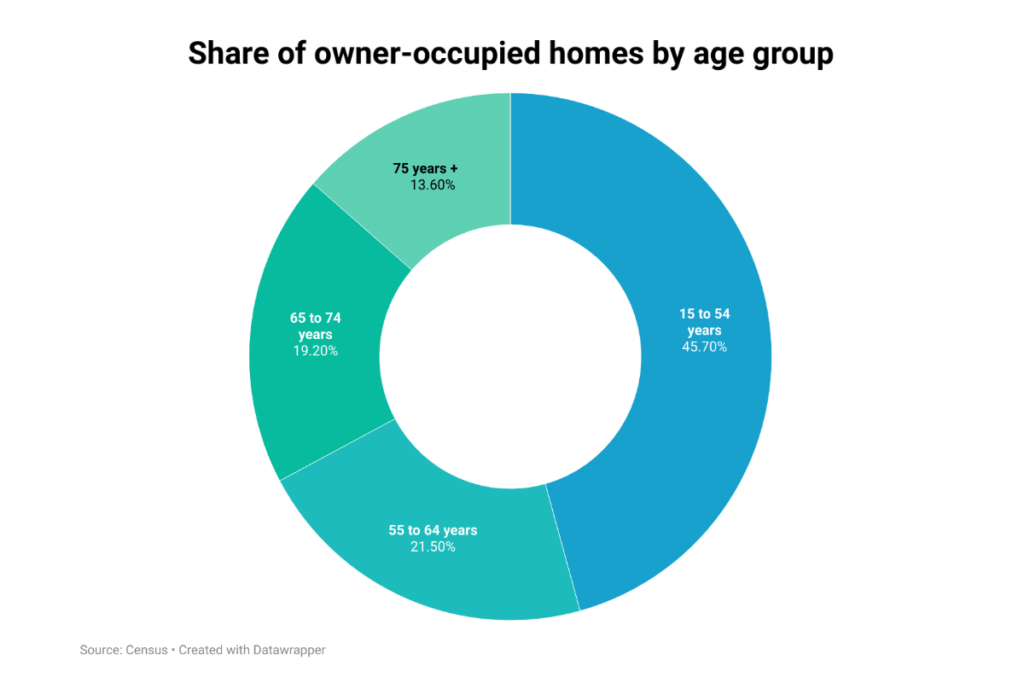

In 2022, a third of all owner-occupied homes are owned by those 65 years or older. With the youngest baby boomers reaching 60 years old in 2024, it’s reasonable to estimate that around half of the homes owned by individuals within the 55-64 age bracket belong to the baby boomer generation. Similarly, a portion of the homes owned by individuals aged 75 and above likely belong to the Silent generation (those born before 1945). These back-of-the-envelope calculations suggest that baby boomers own roughly 38% of homes, even though they constitute just over 20% of the total population.

Why are baby boomers holding on to their homes?

Baby Boomers have experienced a substantial surge in net worth, skyrocketing from $57 trillion in Q1 2020 to an impressive $74 trillion in Q3 2023, constituting a whopping 51.5% of all household wealth. This financial ascent is largely attributed to a $5.6 trillion boost in real estate assets and a $7.4 trillion surge in holdings of corporate equities and mutual funds (Federal Reserve).

What’s more, over half of these boomers own their homes outright, and a significant faction of them cling to low-rate mortgages. Financially, there’s little incentive for them to bid farewell to their cherished abodes and downsize. Additionally, many Boomers whose homes have surged in value now face massive capital gains tax bills when they sell. Moreover, the savings after selling a bigger home and downsizing might not amount to much after paying capital gains taxes, realtor costs and closing costs on a new home.

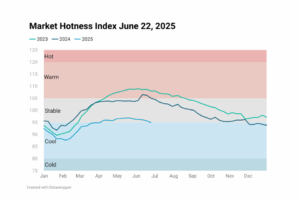

In a nutshell, the housing market’s pulse is dictated by the sheer size and lifecycle dynamics of the Baby Boomer generation, resulting in a current scenario where supply plays hard to get. It seems the boomers are not just shaping history; they’re nesting comfortably in it.