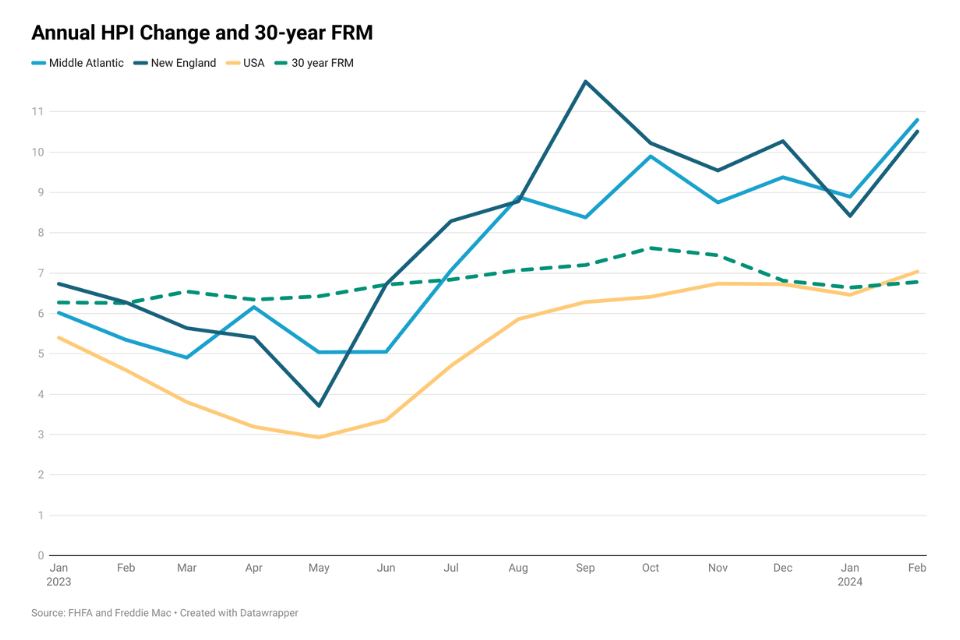

According to the Federal Housing Finance Agency (FHFA), home prices increased by 7.0% from February 2023 to February 2024. Over the same period, the average 30-year fixed-rate mortgage increased from 6.26% to 6.78%. Despite earlier forecasts anticipating rate decreases in 2024, this expectation has yet to materialize. As of May 2nd, 2024, the 30-year rate stood at 7.22% compared to 6.62% at the beginning of January (Freddie Mac). Persistent inflation and a robust labor market have significantly reduced the likelihood of a Federal Reserve rate cut in the first half of 2024, with the Federal Reserve deciding to hold its benchmark interest rate steady on May 01, 2024. Initial expectations of 5-6 rate cuts have dwindled to at most one or two cuts for the year. But the recent slowdown in GDP growth could complicate the Federal Reserve’s policy stance.

There’s been considerable discussion surrounding the affordability challenge amidst rising mortgage rates and home prices. However, despite these increases, homes are still being sold, and prices are climbing. So, who’s driving these purchases? Nearly a third of all buyers in 2023 made their purchases entirely in cash. Additionally, a significant 40% of homeowners own their homes outright, enabling them to navigate high mortgage rates more easily. Some first-time buyers are also entering the market with cash or assistance from family, further contributing to home purchases. With demand outstripping supply and the lock-in effect remaining robust, prices continue to rise, highlighting the persistent shortage of available homes.

The extent of price hikes has been more pronounced in certain regions rather than being a nationwide trend. Price increases from February 2023 to February 2024 in New England and the Middle Atlantic regions stood at 10.5% and 10.8%, respectively, contrasting with a modest 3.7% in the West South Central region (FHFA data). This regional disparity in prices is projected to persist over the next 12 months. Metropolitan areas in New England and the Middle Atlantic, such as Lancaster, Reading, and Harrisburg in Pennsylvania; Rochester, NY; Manchester, NH; and Hartford, CT, are anticipated to experience high single-digit price increases over the next year, according to the Q1 2024 VeroFORECASTSM. Conversely, several metropolitan areas in Texas and Louisiana (West South Central region) are expected to underperform over the next 12 months.

What sets these top-performing cities apart? A key factor is the strong economies and job markets found in many Northeastern cities. The unemployment rate in many states in the Northeast is below the national average. This draws in new residents seeking employment opportunities and drives housing demand, particularly among those with higher earning potential who can better manage increased mortgage costs. Moreover, these cities often feature more affordable home prices compared to larger metropolitan areas, appealing to buyers seeking value. The growing trend of remote work has also given professionals greater flexibility in choosing their place of residence, potentially attracting individuals to desirable Northeastern cities who may not have considered relocation previously.

What lies ahead for home prices in 2024? With high mortgage rates potentially dampening buyer demand, we may see prices continuing to rise, albeit at a slower pace, or potentially stabilizing in certain regions. Strong job markets and limited inventory in some areas could sustain price growth, while others may undergo adjustments. Persistent shortages of available homes are likely to keep prices elevated, although an influx of sellers due to economic factors could temper this growth. Overall, experts generally don’t foresee a housing market crash akin to 2008, citing factors such as stricter lending standards and higher homeowner equity levels.