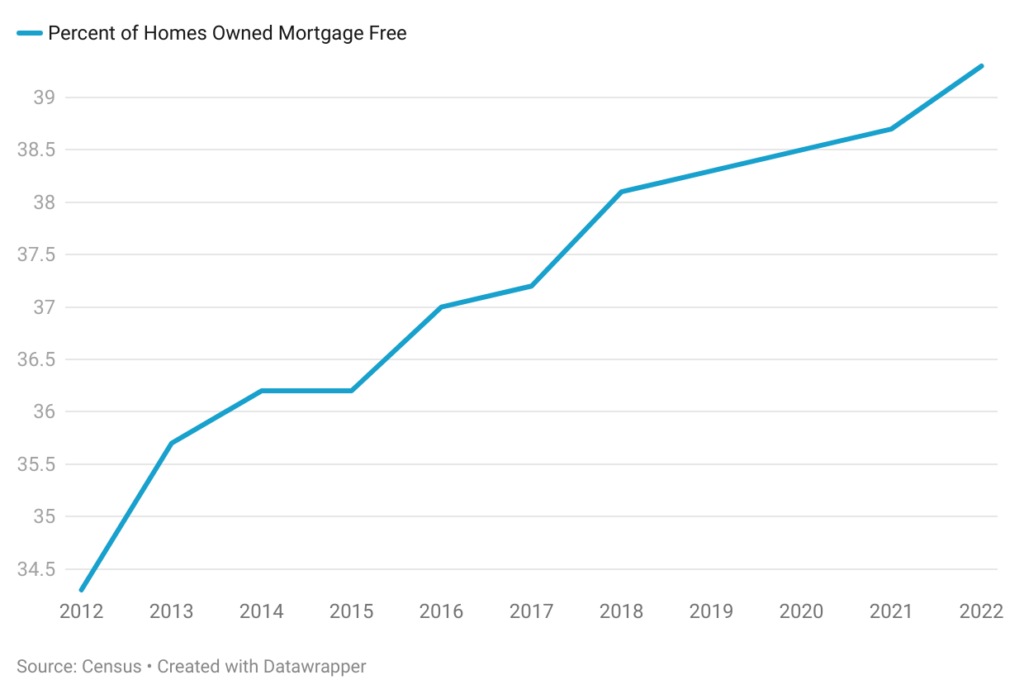

While everyone’s buzzing about those lucky homeowners with ultra-low mortgage rates, millions of homeowners are quietly celebrating a different kind of financial freedom: ditching their mortgages altogether! That’s right, 40% of owner-occupied homes in the US are now mortgage-free. Data from the 2022 Census shows an increasing trend, with the number of mortgage-free homes going up from 25.4 million in 2012 to 33.3 million in 2022. That’s an 8 million surge in just a decade!

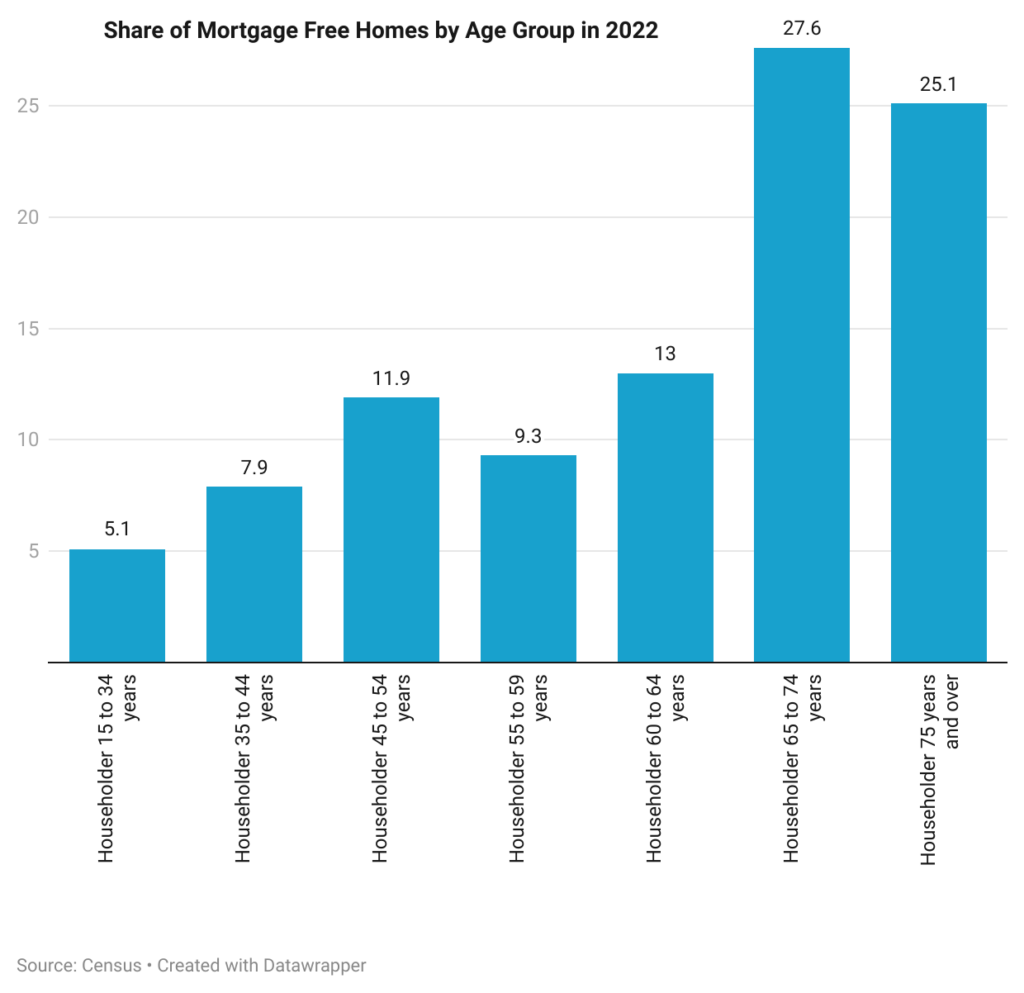

So, who are these mortgage-free owners? Of the 33.25 million owner-occupied homes that were mortgage free in 2022, 27.6% were owned by those in the 65-74 age group, and another 25.1% was owned by people 75 years or older. As expected, the majority of homeowners who own their homes outright are 65 years or older and have likely retired. This allows them the freedom to move or not, with lower costs of living, free from mortgage insurance and payments. From mid-2011 to early 2022, the 30-year mortgage interest rate has remained below 5%. This presented a golden opportunity for millions of American homeowners to refinance their loans. The favorable rates enabled borrowers to transition to shorter-term mortgages without significantly increasing their monthly payments, facilitating accelerated loan repayment.

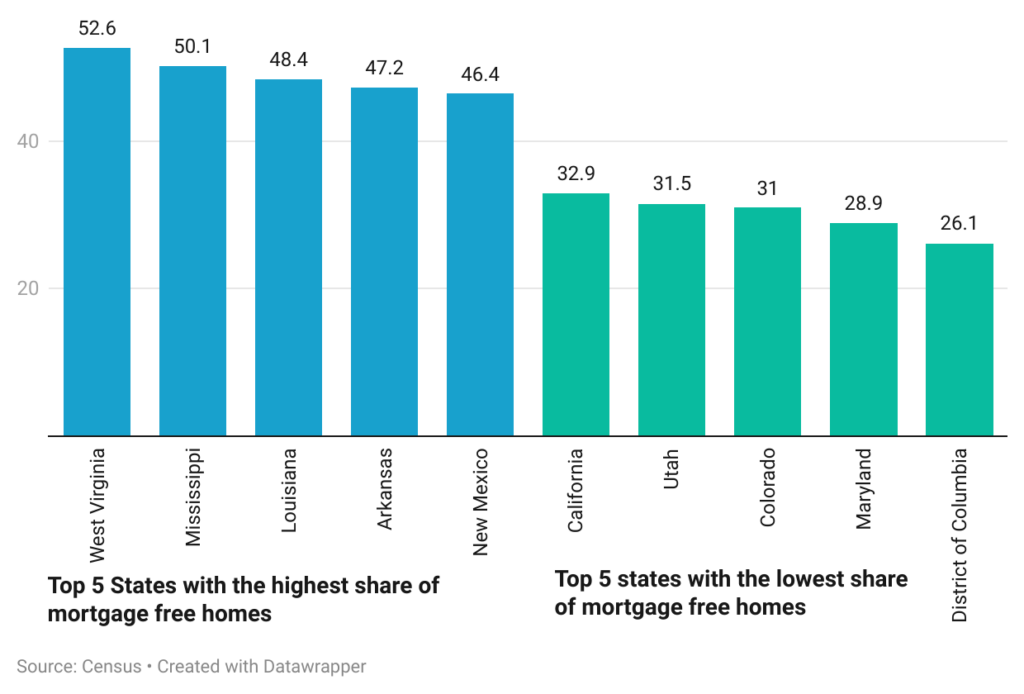

In which states do we find the highest proportion of mortgage free homes? West Virginia tops the list with 52.6% of the homes that are mortgage free, followed by Mississippi, Louisiana, Arkansas, and New Mexico. States with the lowest share of mortgage free homes are District of Columbia, Maryland, Colorado, Utah, and California.

One possible reason for the significant variation in the proportion of mortgage-free homes among states could be attributed to the median home prices. States such as West Virginia, Mississippi, Louisiana, and Arkansas have median selling prices below $300,000. In contrast, the District of Columbia, Colorado, Utah, and California boast median selling prices exceeding $500,000.