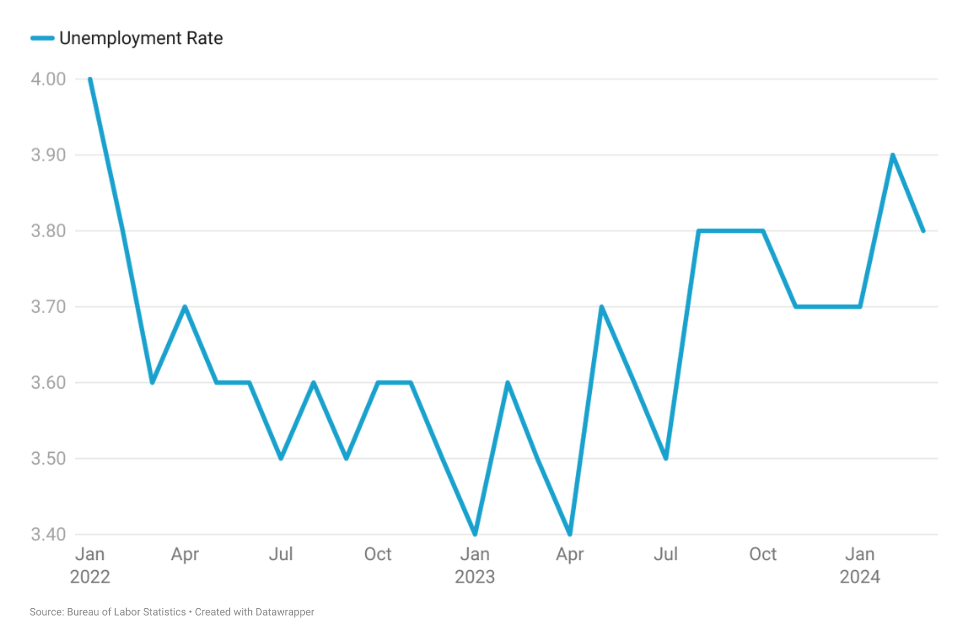

The Bureau of Labor Statistics’ Job Openings and Labor Turnover Summary (JOLTS) for February 2024 showed that total job openings increased from 8.748 million in Jan 2024 to 8.756 million in February 2024. The JOLTS report was supported by the unemployment reading for March 2024, which came in at 3.8%, edging lower from the previous month’s rate of 3.9%. Unemployment has tracked in a narrow range of 3.5% to 3.9% during the last two years, indicating that the labor market has remained resilient despite the Fed rate hikes.

The job market beat expectations in March 2024 with 303,000 new positions created, exceeding the average monthly growth of the past year. Most of the job gains were in health care, government, and construction. Paychecks saw a small bump in March. Average hourly earnings for private sector workers went up 12 cents (or 0.3%) to $34.69. This was a 4.1% year-over-year increase in wages.

Everyone’s been watching economic data closely to see what the Federal Reserve will do next with interest rates. Some experts even predicted 5-6 rate cuts this year, while the Fed itself hinted at only three. But with the economy continuing to perform well in the first quarter, those predictions are changing.

Federal Reserve officials recently suggested they might only cut rates twice this year. And if inflation stays low, there might not be any cuts at all! This is a shift from earlier expectations, as strong economic data, including a robust jobs report, is giving the Fed less reason to lower rates.

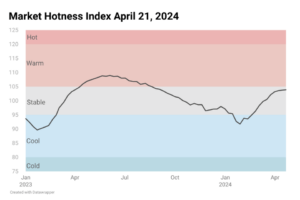

What does all this mean for the housing market? If the Federal Reserve does not cut interest rates as much as some people expected, then mortgage rates probably won’t drop much either. This will certainly price out many first time home buyers as lack of affordability will remain a struggle. Those hoping for rates below 6% will need to wait a while.