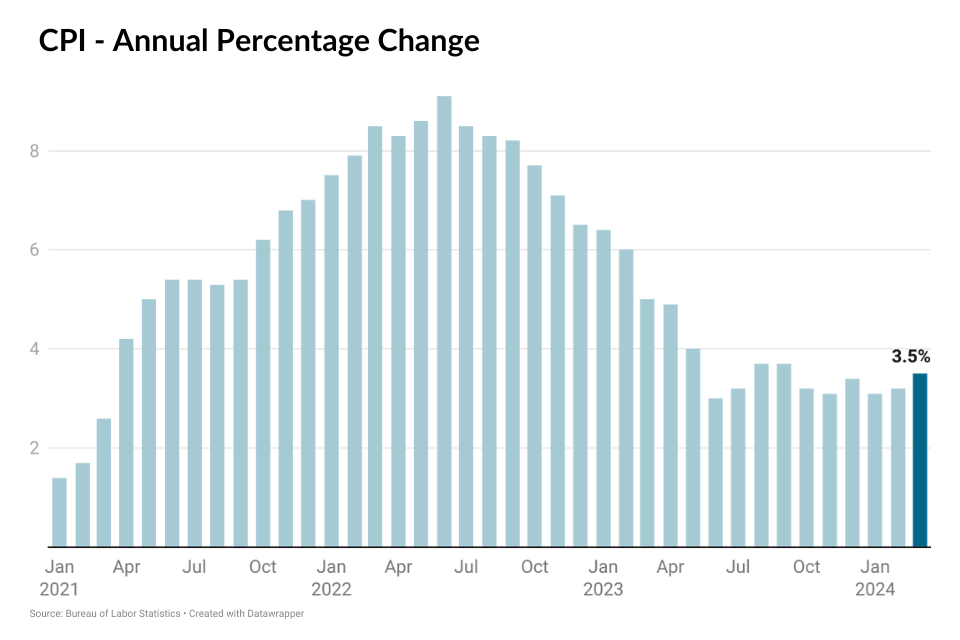

In March 2024, consumer prices surged by 3.5% compared to the previous year, surpassing expectations and representing an increase from February’s 3.2% inflation rate. This inflation update holds significant importance in shaping expectations for the Federal Reserve’s rate policy, as robust price pressures persist.

Excluding food and energy, the core CPI rose by 3.8% compared to the previous year. The increase in CPI was largely propelled by elevated energy and shelter costs. Specifically, housing inflation remained pronounced with a 5.7% year-over-year increase in the shelter component, while energy services saw a 3.1% uptick. Transportation services experienced a sharp annual increase of 10.7%, and motor vehicle insurance surged by 22.2%.

How might this inflation report influence the Federal Reserve’s interest rate policy? When could we anticipate a decision from the Federal Reserve to decrease interest rates? The latest CPI reading suggests that the Fed’s timeline for cutting rates will likely extend further into the second half of 2024. Many analysts are now delaying their expectations for the initial rate cut from June to September. There’s even skepticism regarding whether the Fed will initiate any rate cuts this year. The Fed is exercising caution and waiting to ensure that inflation is effectively managed before taking action on rates. With inflation persistently exceeding the Fed’s target rate and the March 2024 jobs report indicating ongoing strength in the labor market, characterized by a low unemployment rate of 3.8%, the likelihood of a rate cut in June has already diminished.

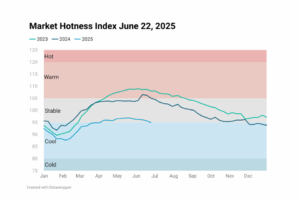

What lies ahead for the housing market? Persistent inflation and the diminishing likelihood of Federal Reserve rate cuts are poised to maintain mortgage rates at elevated levels. Those anticipating mortgage rates falling below 6% by the end of 2024 may need to reconsider their forecasts. The convergence of high rates and soaring home prices will persist as a significant hurdle to affordability for prospective buyers. Moreover, escalating construction costs driven by inflation are expected to curtail housing supply even further, potentially leading to further price hikes.