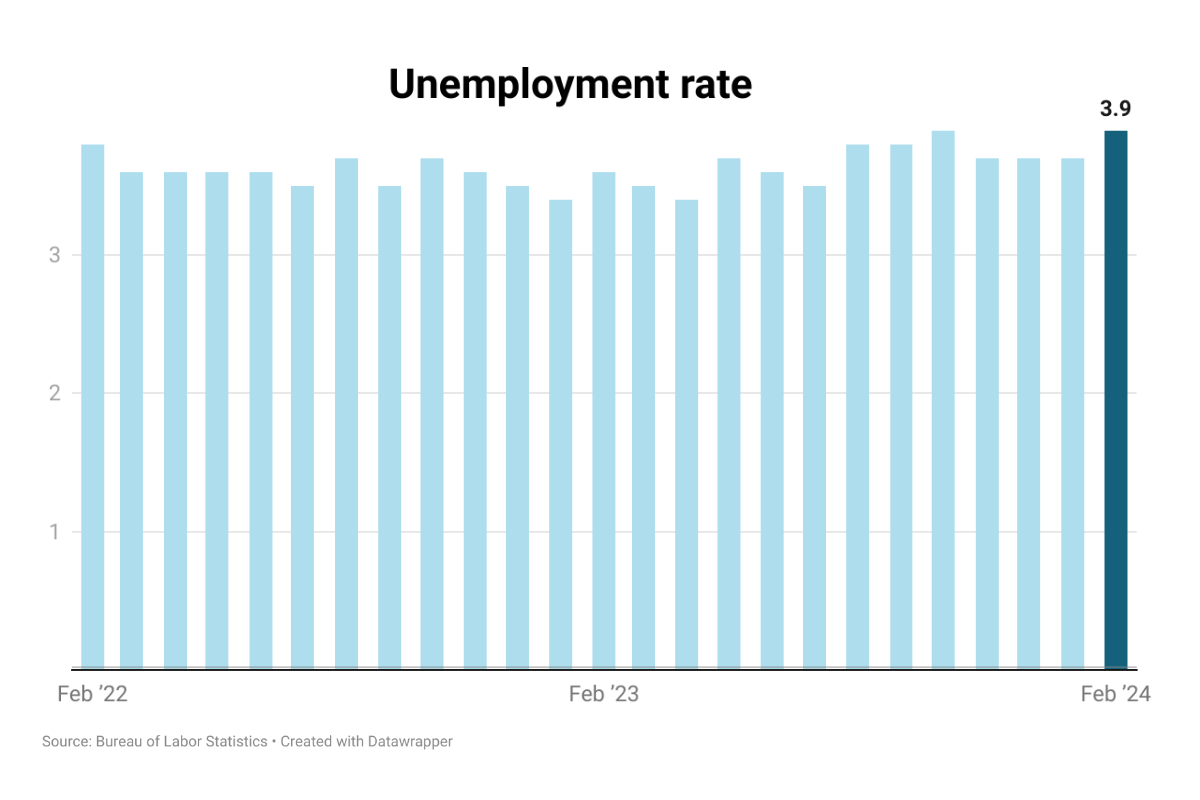

The Bureau of Labor Statistics (BLS) released its unemployment reading for February 2024, which showed an increase in the unemployment rate to 3.9% from 3.7% in the previous month. While this might seem insignificant, it could be an indicator of a softening labor market. An unemployment rate that’s rising suggests more people are looking for jobs but unable to find them. This could be a sign that employers are cutting back on hiring or that job growth is slowing. On the other hand, the report showed an increase of 275,000 jobs in February, exceeding analysts’ expectation of a 198,000 increase. While the payrolls number suggests that the labor market remains strong, the household survey indicates that layoffs were increasing.

A possible reason behind this discrepancy is that the two numbers are based on two different surveys. The unemployment number comes from the Household Survey data (survey of households) that measures labor force status. The Establishment Survey (survey of firms) data provides the nonfarm payroll employment figures. One plausible source for the gap can be attributed to the phenomenon of multiple jobholding. The payroll survey tallies the total number of jobs in the economy, potentially capturing instances of individuals holding multiple jobs. In contrast, the household survey focuses on counting the number of employed individuals, potentially resulting in comparatively lower estimates of employment due to the prevalence of multiple jobholders.

While the unemployment rate had held steady at 3.7% for three months, the latest reading of 3.9% is the highest in two years. A year ago, the unemployment rate was 3.6%. Additionally, while the nonfarm payrolls increased by 275,000, the numbers for December 2023 and January 2024 were adjusted lower by 167,000 each, suggesting that the economy created fewer jobs than what was previously reported. It is important to note that this is just one data point, and a single month’s report doesn’t necessarily signal a trend. The report also showed that average hourly earnings for all employees on private nonfarm payrolls increased by 4.3% y-o-y to $34.57. This of course means putting more money into the pockets of consumers. An important statistic to note is that the Baby Boomers generation, that is 73 million strong, currently holds an impressive $74 trillion in wealth, and is largely immune to the labor market trends.

The labor market statistics are being closely watched by the Federal Reserve to see if this is the start of a weakening labor market and how it will weigh on its interest rate policy going forward.

Veros’ forecast for unemployment for February 2024 was 3.8% compared to the BLS’s reading of 3.9% and predicts that the labor market will show a gradual weakening, with the unemployment rate expected to inch up to 4.1% by 2024 end.