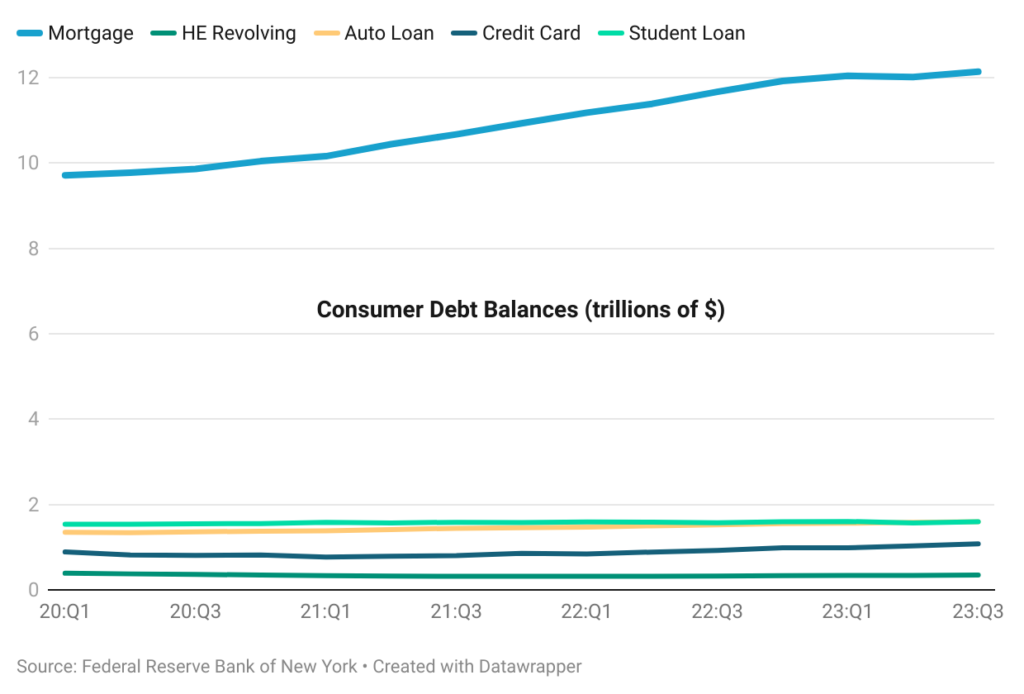

Data released by Federal Reserve Bank of New York in their Quarterly Report on household Debt and Credit shows that consumers added $228 billion in debt from Q2 2023 to Q2 2023 to reach $17.29 trillion. The debt burden increased by 4.8% or $786 billion from Q3 2022 to Q3 2023. The largest component of debt was mortgages at $12.14 trillion, rising 4% from Q3 2022 but a staggering 23% from three years ago. During the same time (Q3 2022 to Q3 2023), credit card balances increased by 16.6%, while auto loans increased by 4.7% and student loans by 1.6%. Year over year, credit card balances grew by more than 15% in each quarter since Q3 2022.

During 2022-2023, the Fed increased rates eleven times to slow inflation, so that rates are up, and credit card debt is up. Consumers have kept spending despite rising interest rates and high inflation, primarily because of a strong labor market. However, this might be testing some consumers’ ability to repay debt. Credit card balances that have transitioned into serious delinquency (90+ days) have increased from 3.69% in Q3 2022 to 5.78% in Q3 2023. The younger borrowers are suffering most with respect to making timely payments. Credit card balances with serious delinquency have increased from 6.9% to 9.3% for the 18-29 age group and from 5% to 8.3% for the 30-39 age group. These percentages are much lower for the other age groups. A weakening in the labor market would raise concerns about rising consumer debt and delinquency levels. Furthermore, the conclusion of the current federal student loan payment forbearance might not only lead to an increase in education loan delinquencies but also potentially impact credit card and auto loans.

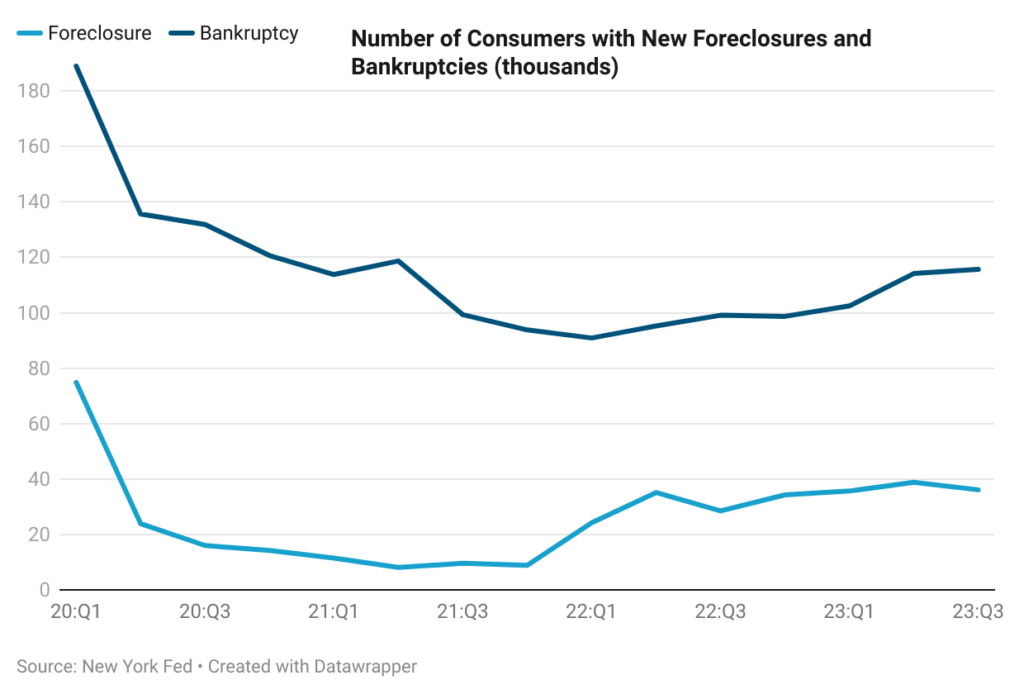

The number of new bankruptcies has trended upwards since Q1 2022; foreclosures increased from Q1 2022 to Q2 2022 but have remained steady since. The current rates of foreclosures and bankruptcies, however, are much lower than the pre-pandemic rates. Foreclosures are expected to remain low since a large percentage of homeowners with mortgages have locked into sub-4% contracts and built considerable equity.