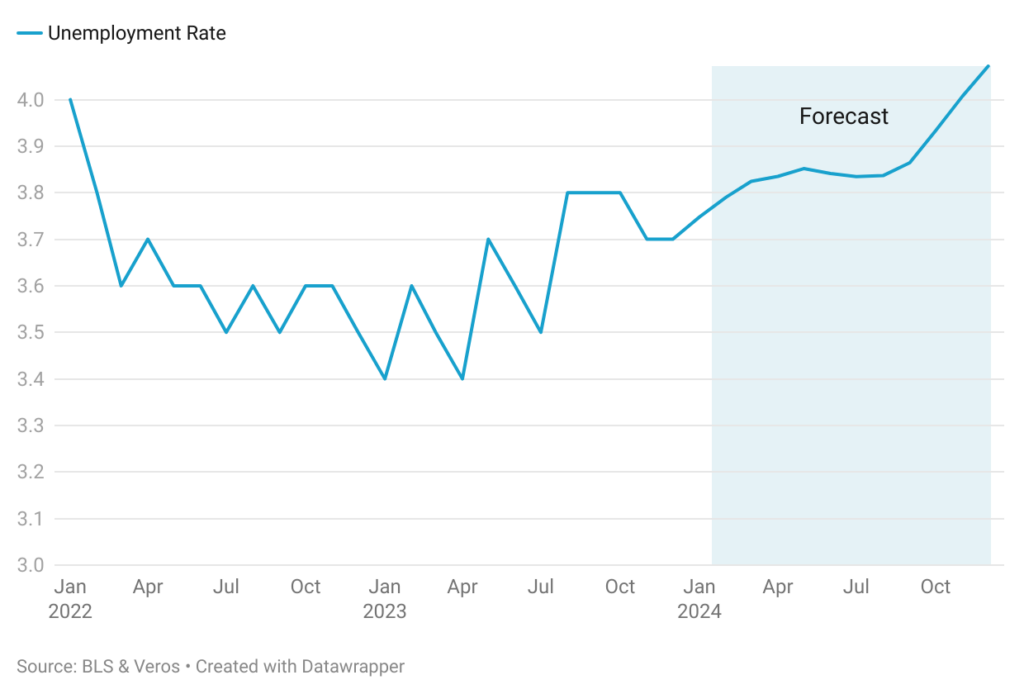

The official unemployment rate, as reported by the Bureau of Labor Statistics (BLS) in their “The Employment Situation” report for December 2023, held steady at 3.7%. This matches the level reported in November 2023 and remains near historical lows. Despite the Federal Reserve’s aggressive interest rate hikes in 2022 and 2023, the employment situation has remained robust, with the unemployment rate holding below 4% for almost two years.

While the headline rate stays stable, underlying data reveals some shifts. The economy added 216,000 non-farm jobs in December, continuing a positive trend but reflecting a slight slowdown compared to previous months. Additionally, most of the job gains were in the government, health care, social assistance, and construction, while transportation and warehousing lost jobs. A notable point is that the civilian labor force declined by 676,000, with the labor force participation rate declining by 0.3% from 62.8% in November to 62.5% in December and the number of people employed declining by 683,000. While wages have increased, the rate of growth is not as rapid as observed earlier in the year.

Veros’ forecast expects the unemployment rate to remain around high-3% to 4% throughout 2024. Continued economic growth is expected, but factors like elevated interest rates and global uncertainties could impact future job creation and potentially push the unemployment rate higher in the longer term. Inflation has been declining, but it is still well above the target rate of 2%. While the Federal Reserve has signaled three rate cuts for 2024, the timing and number of potential cuts is uncertain. Many expect the Federal Reserve to hold interest rates higher for longer. Since unemployment is just one of the drivers of the housing market, the current unemployment forecast is unlikely to significantly impact housing demand.