Over the past decade, the U.S. housing market has been undergoing a quiet transformation. While headlines often focus on mortgage rates, housing inventory, or soaring prices, one of the changes lies in the demographic composition of homebuyers. From 2015 to 2025, a trend has emerged: today’s home buyer is older, wealthier, and more likely to purchase a home for multi-generational living.

In 2015, the housing market was relatively youthful. According to the National Association of Realtors® (NAR), nearly one-third of all homebuyers were 34 years old or younger, while just a quarter were aged 60 or older. By 2025, the balance had tipped; only 15% of buyers were aged 34 or younger, whereas almost half were 60 or older. This aging of the buyer pool is now a defining feature of the U.S. housing landscape.

According to the NAR, baby boomers now make up the largest segment of homebuyers—overtaking millennials, who previously led the market for several years. Many of these older buyers are downsizing or relocating for retirement or to be closer to family and friends, but collectively they are purchasing more homes than any other generation.

Another evolving development in recent years is the rise in multigenerational living. In 2015, just 13% of homes purchased accommodated multiple generations under one roof. By 2025, that figure had grown to 17% (NAR). Buyers in their 40s and 50s are especially likely to pursue this type of housing, often combining resources with aging parents or adult children. The motivations range from caregiving needs to economic practicality. As housing costs increase, families find that living together is not just viable—it’s sometimes necessary.

At the same time, first-time homebuyers are shrinking in share. They made up a consistent 33% of all buyers in 2015 and 2020, but by 2025 that figure had fallen to 24% (NAR). This decline signals the increasing difficulty many young Americans face in entering the market. Industry surveys and reports show that many potential buyers are postponing homeownership or depending on family assistance. In fact, a growing number of first-time buyers are receiving financial help from parents or relatives to fund down payments—a trend that’s become common enough to earn a nickname: “nepo-buyers.”

While the median price of a home has increased substantially, home sizes have held fairly constant. In both 2015 and 2020, the typical home purchased measured about 1,850 square feet and 1,900 square feet in 2025. That figure has remained relatively stable even as prices have surged, indicating that buyers are often paying more without receiving more space.

Another changing feature is the percentage of buyers who finance their homes. In 2015, nearly 90% of buyers used a mortgage. That figure dipped to 86% in 2020 and dropped to 74% in 2025 (NAR). This is largely attributable to the growing presence of older, wealthier buyers who are able to purchase homes with cash. NAR data shows that nearly half of all purchases by baby boomers in 2025 were cash transactions, in stark contrast to younger buyers who still rely heavily on financing.

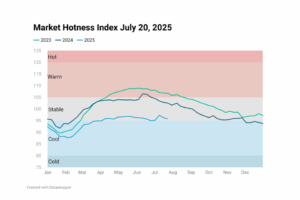

Unaffordability is reflected by the widening gap between home prices and wages. In June 2015, the national median home price stood at $236,300. A decade later, in June 2025, that figure had climbed to $435,300—an 84% increase. During the same period, average hourly earnings rose from $24.95 to $36.30, a 45% increase (Bureau of Labor Statistics). While wages have grown, they have not kept pace with the surging cost of housing. This disparity means that in 2025, the average American must work significantly more hours to afford the same home they could have purchased in 2015. The affordability gap has become one of the most serious structural barriers for today’s buyers—especially those without equity from a prior home.

These shifts collectively reveal a housing market that’s increasingly shaped by older, financially established individuals. For homebuilders and policymakers, these trends present both challenges and opportunities. Homes with accessible designs, flexible floorplans, and multigenerational layouts are likely to become more important. At the same time, longer-term demographic trends—including declining birth rates and slowing household formation—could suppress future demand. While the current surge in older buyers will sustain the market in the short term, planners and developers must consider the implications of a population that is aging faster than it is growing.