As we enter the new year, anticipation surrounds the housing market’s trajectory. Will it revert to its pre-pandemic state? Is an era of more affordable homes on the horizon? Are we bracing for a ‘silver tsunami,’ as baby boomers downsize and flood the market with homes? In short, the answer is no. The housing market is poised to carry forward the trends of 2023 – characterized by low supply, small price hikes, and lingering challenges of affordability.

Housing Supply

The scarcity of homes nationwide is significantly influenced by a large number of homeowners who locked in historically low rates in 2020 and 2021. Approximately 60% of existing mortgages boast contract rates below 4%. As of December 2023, the 30-year fixed mortgage rate stands at 6.6% and Veros’ forecasts suggest that rates will remain at mid-six levels throughout the first half of 2024. Consequently, those who purchased or refinanced during the era of low rates are reluctant to sell their homes and switch to a new property with a considerably higher mortgage interest rate. The limited housing supply is fostering competition among buyers, contributing to an increase in prices.

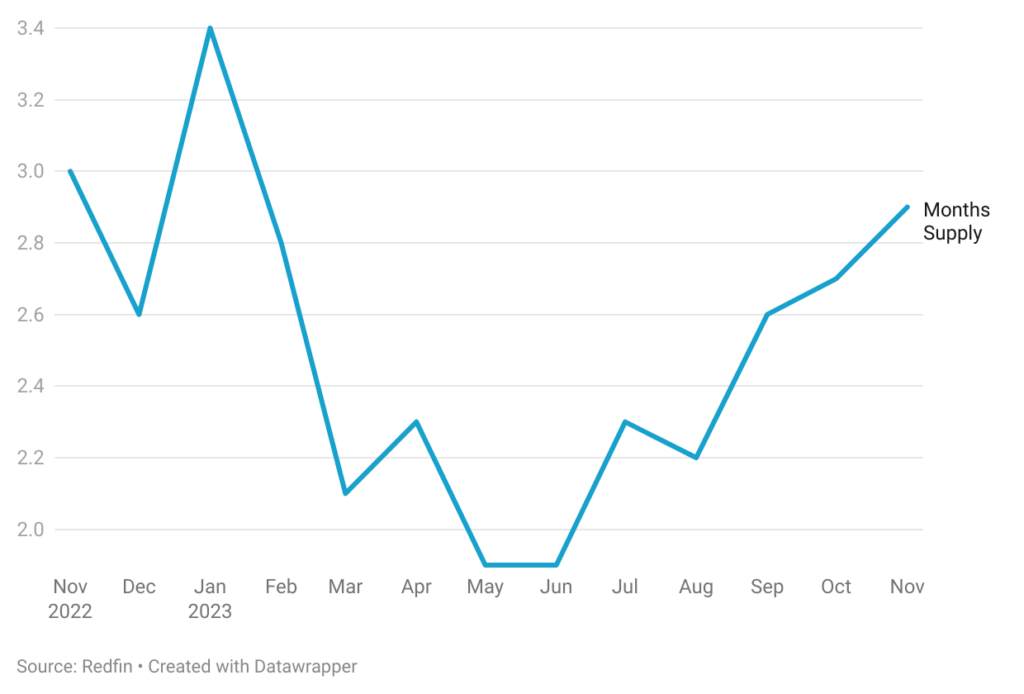

Redfin data indicates that the month’s supply in November 2023 was 2.9, slightly lower than the reading of 3.0 in November 2022, while nationwide months’ supply had dipped below 2.4 during the spring and summer months, which typically witness increased housing market activity. Moreover, even when the 30-year fixed mortgage rate was lower than the current 6.6% for much of the first half of 2023, it did not result in an increase in housing supply.

Contrary to some expectations, we should not expect a surge of houses in the market as baby boomers retire and downsize. Census data highlights that homeowners over the age of 65 currently own a third of all homes and 53% of all mortgage-free homes. Additionally, many of them are opting to work longer and retire in place, signaling that a substantial increase in the supply of homes from this demographic is not expected.

House Prices and Affordability

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

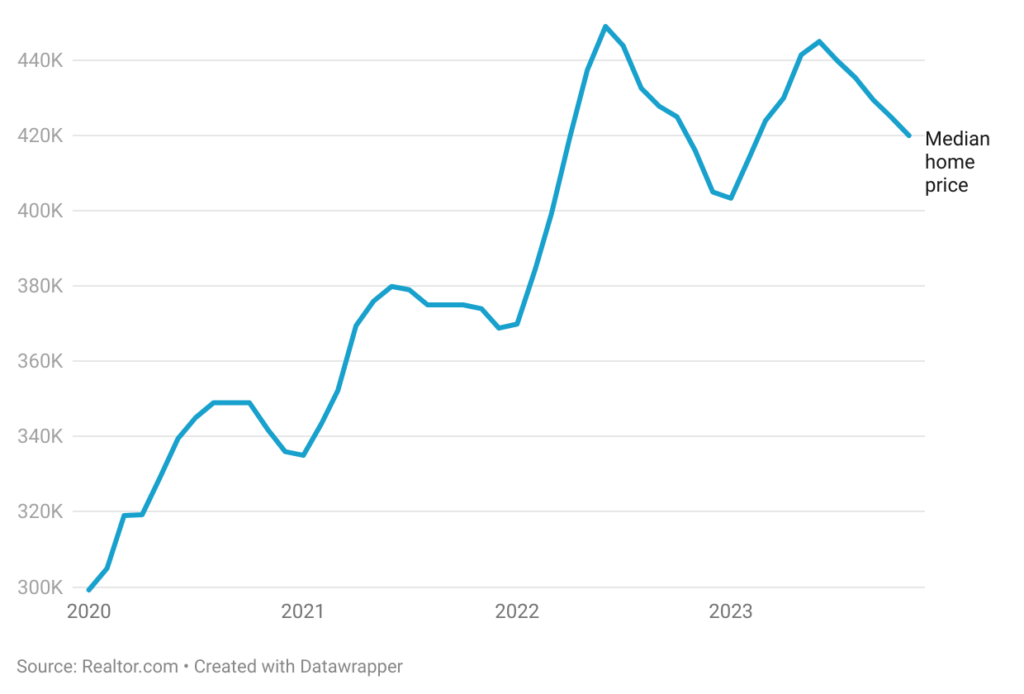

Affordability challenges stood out as a defining feature of the 2023 housing market, along with the issue of low supply. Based on data from Realtor.com, the median selling price, which was under $300,000 at the beginning of 2020, has surged to over $400,000 by the close of 2023. Veros’ forecast predicts that home prices will rise another 2.4% during 2024. Most other projections call for prices to remain steady or rise further. Additionally, predictions of mortgage rates not dropping below the mid-six levels indicate that concerns about affordability are likely to persist into 2024.

The scarcity of supply and issues with affordability are, in part, outcomes of the Federal Reserve’s series of rate hikes during 2022-2023. While the Fed has suggested the possibility of three rate cuts in 2024, the impact on affordability is not expected to be substantial and neither will it release most homeowners from the lock-in effect of low mortgage rate contracts.