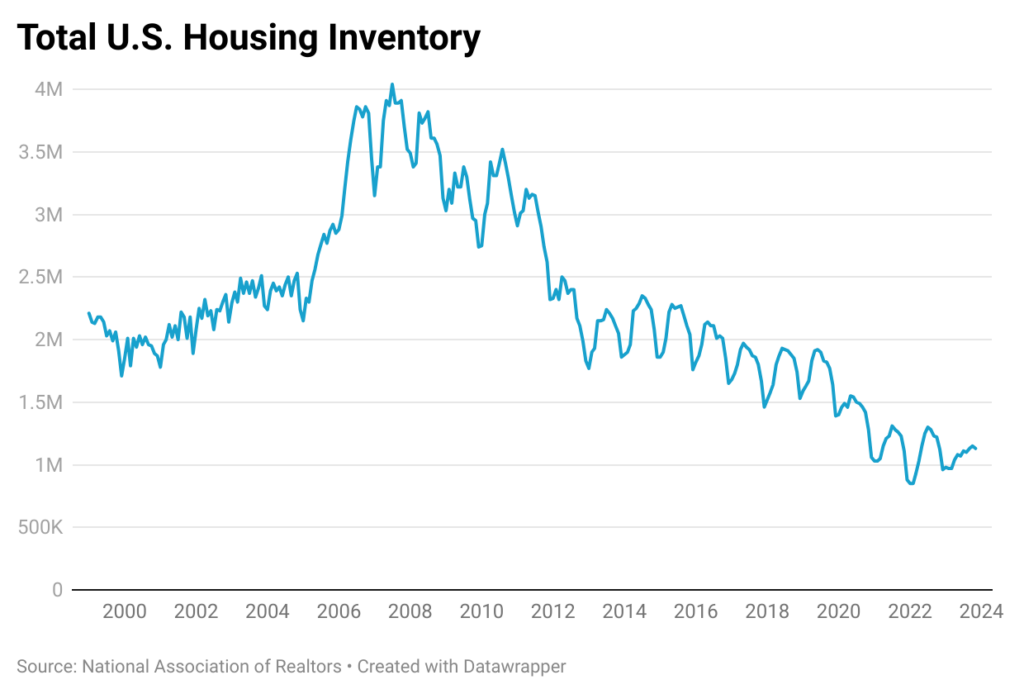

The current housing landscape starkly contrasts with the Great Recession of 2008, with a notable factor being the acute shortage of available homes. Unlike the excess inventory seen in the 2007-2008 period, existing homes for sale in November 2023 numbered less than 1.2 million, a significant departure from the three million-plus during the Great Recession.

A Dominance of Mortgages with Low-Rate Contracts

2023’s housing market was defined by the “lock-in” effect. Homeowners with low-rate mortgages did not want to sell their homes and purchase another at a higher rate.

Data from the Federal Housing Finance Agency (FHFA) reveals a surge in mortgages with rates below 3%, rising from 4.8% in Q2 2020 to 22.6% in Q3 2023. This can be attributed to the fact that during the latter half of 2020 and the initial quarter of 2021, the 30-year fixed mortgage rate remained below the 3% threshold. Homeowners quickly leveraged this opportunity, opting to refinance their existing mortgages at these lower rates, thereby facilitating more manageable mortgage payments.

In Q2 2020, there was a significant increase in the proportion of mortgages with a contract rate of 3-4%, rising from 31% in Q2 2019 to 38% in Q2 2020. This can be attributed to the 30-year fixed mortgage rate slipping below 4% in May 2019 and remaining in the 3-4% range until mid-2020, when it decreased even further. In Q3 2023, nearly 79% of all mortgages had a contract rate of less than 5%, which is about 1.6% lower than the current mortgage rate. With a 20% down payment, a $400,000 home would cost $1,349 per month at a 3.0% interest rate, $1,718 at a 5.0% interest rate, and $2,043 at a 6.6% interest rate (calculations based on zero property taxes, no home insurance and HOA fees).

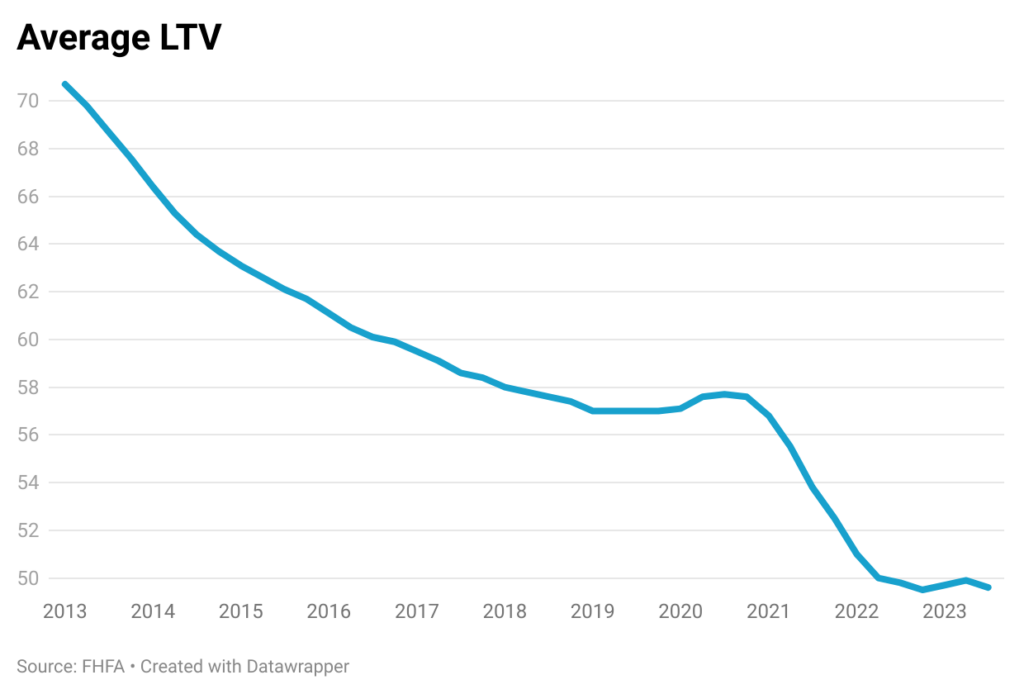

Low Loan-to-Value Ratios

As home values continue to appreciate, the loan-to-value (LTV) ratios for mortgages have decreased, resulting in reduced foreclosure rates compared to the 2008 financial crisis. The average LTV ratio declined from 57% in Q1 2020 to under 50% in Q3 2023. In the face of financial difficulties, homeowners with equity can explore various options, including selling, obtaining a Home Equity Line of Credit, or refinancing.

Investor Impact on Inventory

The substantial purchase of homes by investors, either for rental or flipping, is another factor limiting inventory. Investors acquired nearly 16% of single-family homes in the Q3 2023, according to Redfin data. This trend restricts the available homes for traditional buyers, as investor purchases take properties off the market for extended periods.

In summary, the contemporary housing market continues to grapple with a persistent low supply of homes. Since mortgage rates are not expected to dip much further in 2024 compared to the current 6.6%, we expect supply to remain constrained.