Given the current national housing market news about slumping home sales, increased contract cancellations and sellers offering concessions or even delisting, Hartford, CT stands out as a local hot spot.

According to veteran Hartford, CT, real estate agent Lisa Barall-Matt, the local market remains a “very solid seller’s market.” She notes that properties in good condition, located in desirable areas, are “still selling very well,” often attracting 10-12 offers on a property and closing well above the ask price. This is a stark contrast to a national market where buyers are reportedly on the sidelines, waiting for rates and prices to drop.

Why Is Hartford So Different?

Lisa believes that before the pandemic, Connecticut’s market was significantly behind the rest of the country in terms of pricing. This made it an attractive destination when people began relocating. “California, Colorado, New York, Boston. People were flocking here literally in droves,” she said. To these out-of-state buyers, Connecticut’s prices were so inexpensive that they could pay much more without hesitation, kickstarting the current trajectory of price increases.

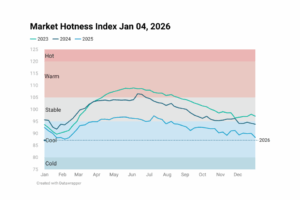

Further, the supply of homes remains a critical bottleneck. While Lisa noted a slight increase in inventory in West Hartford—from 19 single-family homes a year ago to 40 today—she emphasizes that a normal market would have around 250 properties. In terms of months’ supply, this measurement has decreased from 3-4 months’ supply before the pandemic (2019), to under 2 months in mid-2025. This scarcity, fueled by a lack of new construction, keeps demand high.

The Unconventional Buyer and the Bottlenecked Seller

Lisa’s experience in her market also challenges conventional wisdom about today’s buyers and sellers. Despite high mortgage rates, Lisa is not seeing buyers retreat. She notes that many buyers come with significant down payments, often 35% or 40%, making a full loan unnecessary. She is even seeing first-time homebuyers with budgets of $750,000—a level she would have never seen pre-pandemic. The median sales price of an existing single family has gone up 82% from Q1 2020 to Q2 2025, according to NAR data.

On the other hand, sellers are a major part of the inventory problem. “Our home sellers all took advantage of getting their 2 and 3% mortgage rates,” Lisa explained. Many are choosing to stay put and remodel their current homes rather than selling and taking on a new, much higher mortgage. The properties that are coming onto the market are often the result of life changes, such as families relocating or aging parents moving closer to their children.

What’s Next for the Hartford Market?

While the market has been exceptionally strong, Lisa believes a shift is on the horizon. She noted that while West Hartford saw a 10% year-over-year price increase, she doesn’t believe this is sustainable.

“I’m starting to see some cracks in the pavement,” she shared. Her “crystal ball” predicts a shift to a more modest 5% increase over the next year. This change, however, will not be drastic. She expects the market to remain “deprived” of inventory, preventing any significant downturn.

Ultimately, Lisa’s insights serve as a powerful reminder that while national housing news provides a general pulse, a market’s true health is always local. In Hartford, robust demand, low inventory, and a unique demographic influx continue to power a solid seller’s market, bucking the national trend.