Current Inflation Snapshot

For July 2025, the U.S. inflation rate held steady at 2.7%, matching June’s level. Yet beneath this surface calm, core inflation—which excludes volatile food and energy prices—picked up pace, rising at 3.1%, the highest rate since February. Broadly, tariffs applied on consumer items are starting to show up in services and core components, adding to inflation persistence.

The producer price index jumped 0.9% m-o-m in July, marking the largest monthly gain since June 2022. This pushed y-o-y PPI to 3.3%, reflecting a strong upward trend in producer-level inflation. Rising PPI pressures limit the Fed’s flexibility on rate cuts. However, moderation in core PPI offers a glimmer of relief that inflationary forces may be weakening further down the chain.

July’s data paints a mixed inflation picture: while PPI shows pronounced cost pressures, CPI remains stable overall but with strong core inflation, especially in services. For the Fed, this means navigating between these conflicting indicators—balancing inflation risks against a softening economy. The September FOMC meeting will spotlight whether core inflation momentum fades or demands continued caution.

The Labor Market: Signs of Softening

The July jobs report painted a weakening picture of the US labor market, showing that only 73,000 jobs were added, with significant downward revisions totaling 258,000 fewer jobs for May and June. The unemployment rate nudged up to 4.2%. Most gains were isolated in healthcare and social assistance, while manufacturing and professional services shrank, and federal employment fell sharply. Although headline unemployment remains modest—hovering around 4%—labor market indicators are flashing caution. The overall labor force participation rate has stalled, hampered by tighter immigration policies and resulting worker shortages.

Despite low headline unemployment, labor force participation is stalling—now at its lowest since 2022. This is suppressing unemployment figures as many people have simply stopped looking for work. Working mothers are among the biggest contributors to this decline: from January to June 2025, mothers aged 25–44 with young children dropped out of the workforce at the fastest rate in three years, driven by the rollback of flexible work, return-to-office mandates, and childcare pressures. A shrinking labor force can make the unemployment rate appear deceptively low. When discouraged workers or retirees exit the labor force, they’re no longer counted as unemployed—even if they would work under different conditions.

Meanwhile, Federal Reserve officials are noting that labor market softness may justify upcoming rate cuts. Citing sluggish job gains and a higher unemployment rate (~4.2%), some Fed officials now support three interest rate cuts in 2025.

Impact on mortgage rates and housing market

The interplay of steady inflation and a cooling labor market has nuanced implications for mortgage rates. Higher core inflation generally limits room for rate reductions, keeping mortgage rates elevated. However, signs of a slowing labor market may tilt the balance toward easing monetary policy. As a result, markets are pricing in a modest decline in mortgage rates toward mid-to-low 6% territory by year-end.

Home affordability is under significant pressure. The national income required to afford a median-priced home soared to $126,670 in 2024, a 60% increase over just three years, while median household income has barely budged. Couple this with high insurance and property taxes and owning now costs far more than renting in most U.S. cities.

Further, economic and financial pressures—including persistently high mortgage rates and job uncertainties—are discouraging relocation. Both job mobility and residential moves have reached record lows, especially affecting first-time homebuyers and young professionals.

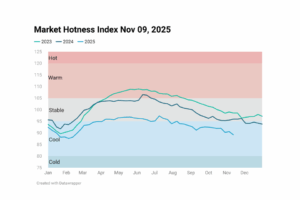

Market Outlook

Borrowing costs remain elevated, compressing affordability and limiting buyer demand. Supply-side constraints—such as construction delays and tariff-related cost increases—are helping sustain prices. If labor market deterioration continues, mortgage rates may slightly improve, easing pressure on future buyers around late 2025 or early 2026.

The current economic indicators reflect a precarious balancing act. Sticky core inflation keeps policy conservative, while softness in the labor market raises hopes for rate relief. These dynamics are fueling a challenging housing landscape—particularly for first-time buyers and those planning to move. The next few months will be critical in determining whether mortgage rates ease and affordability improves, or if housing stagnation persists.