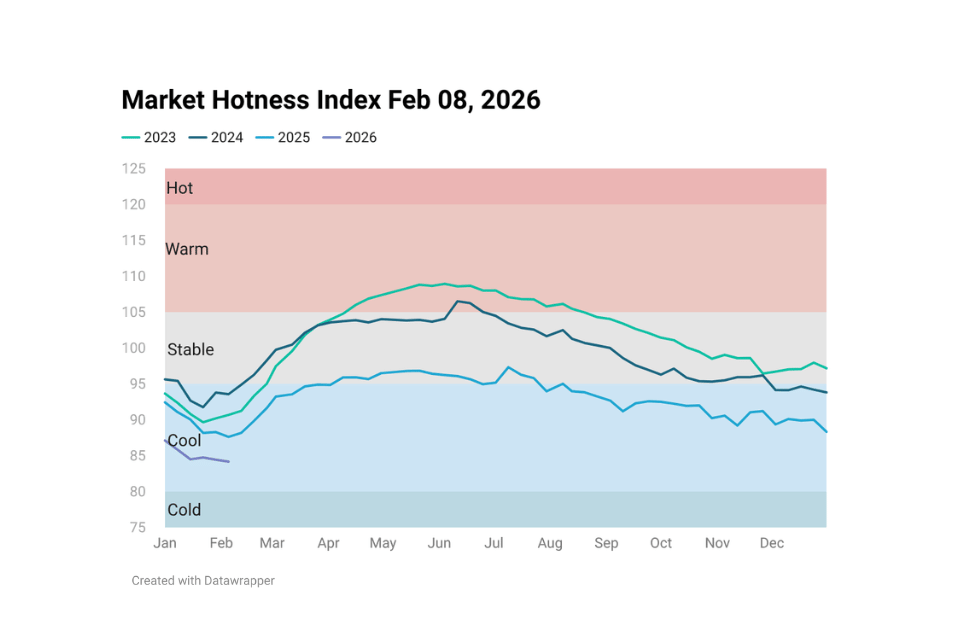

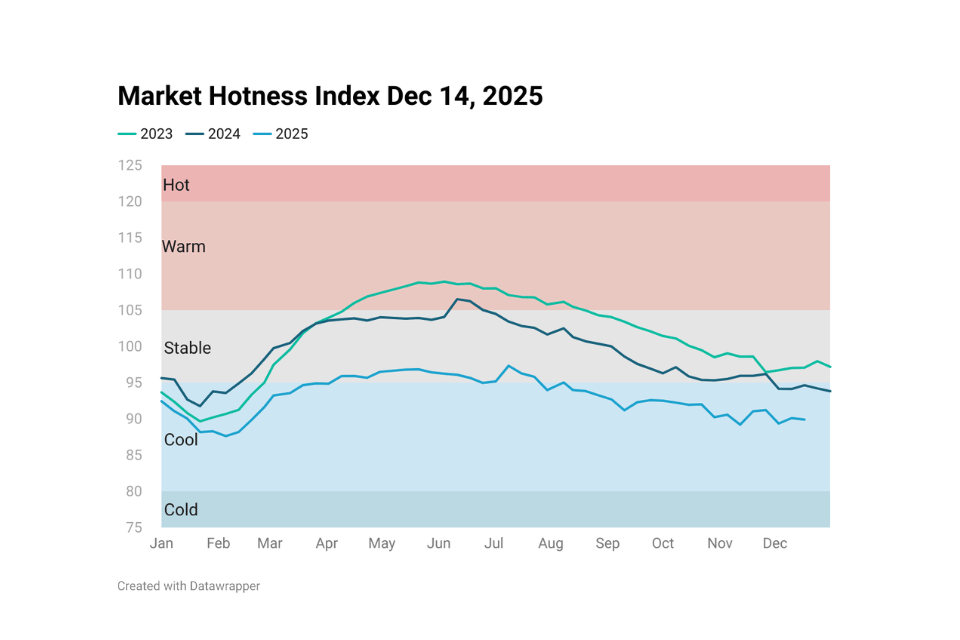

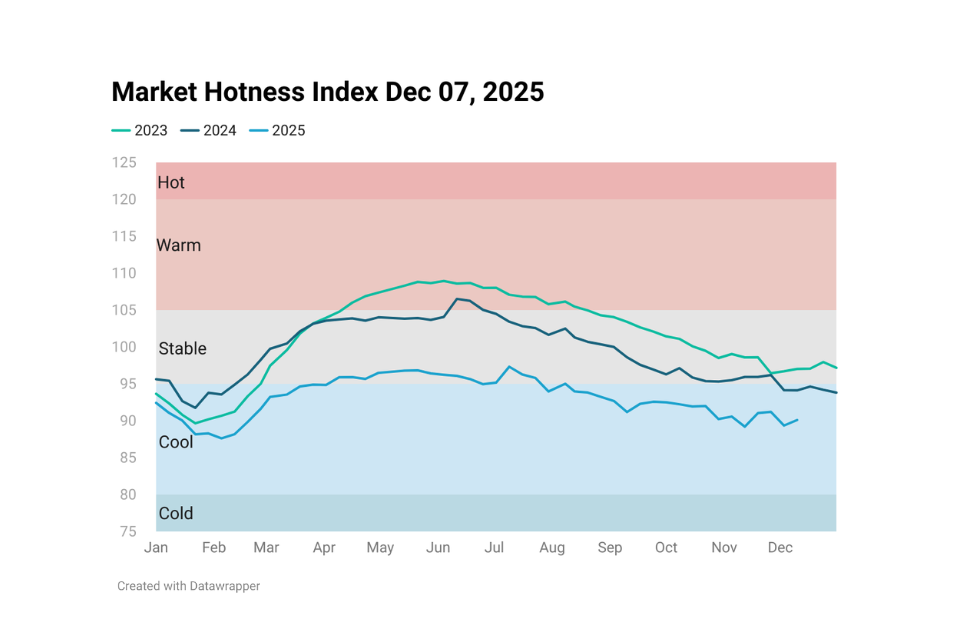

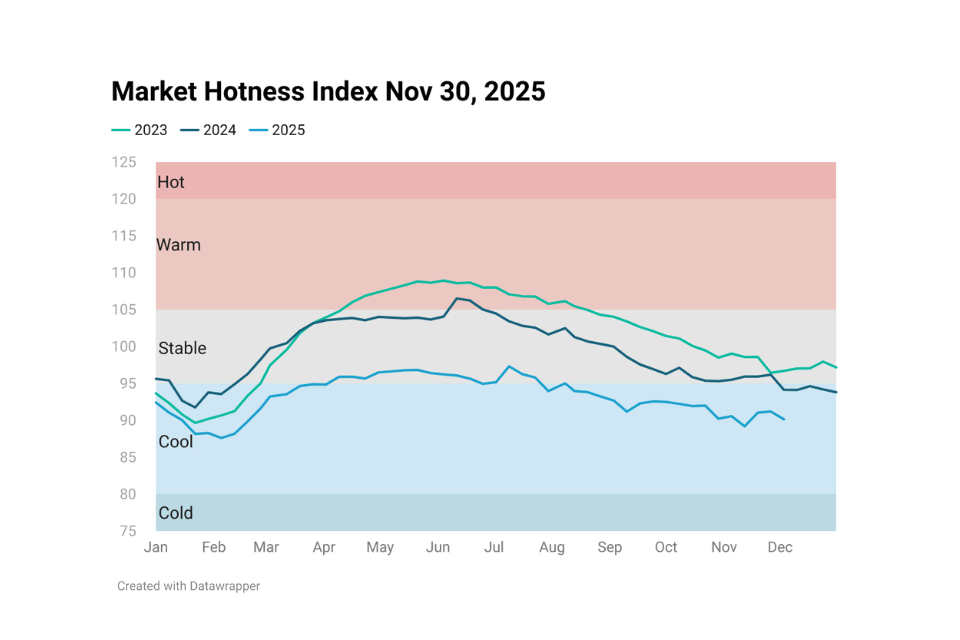

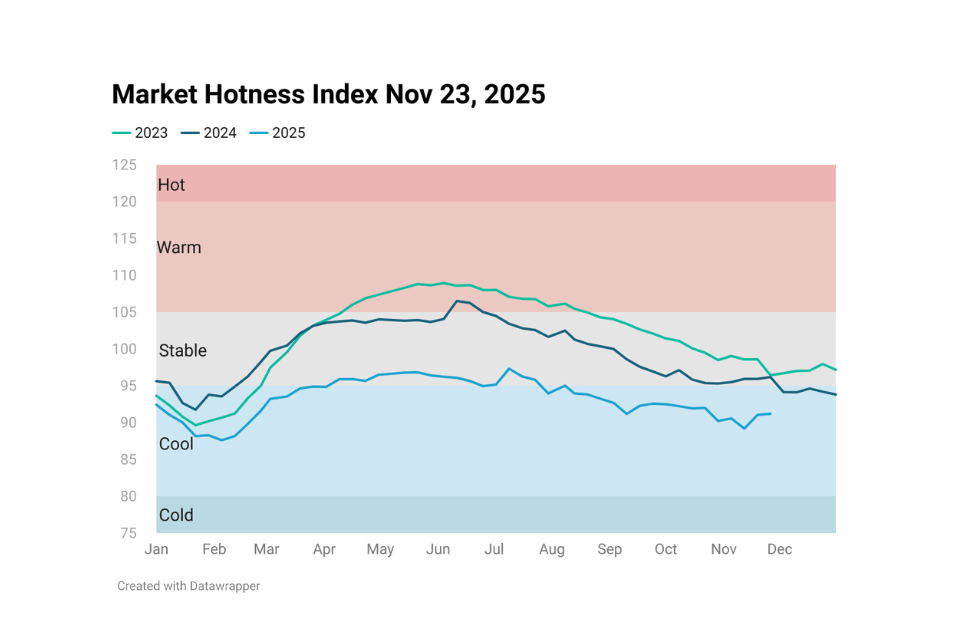

Housing Market Hotness Index Feb 08, 2026

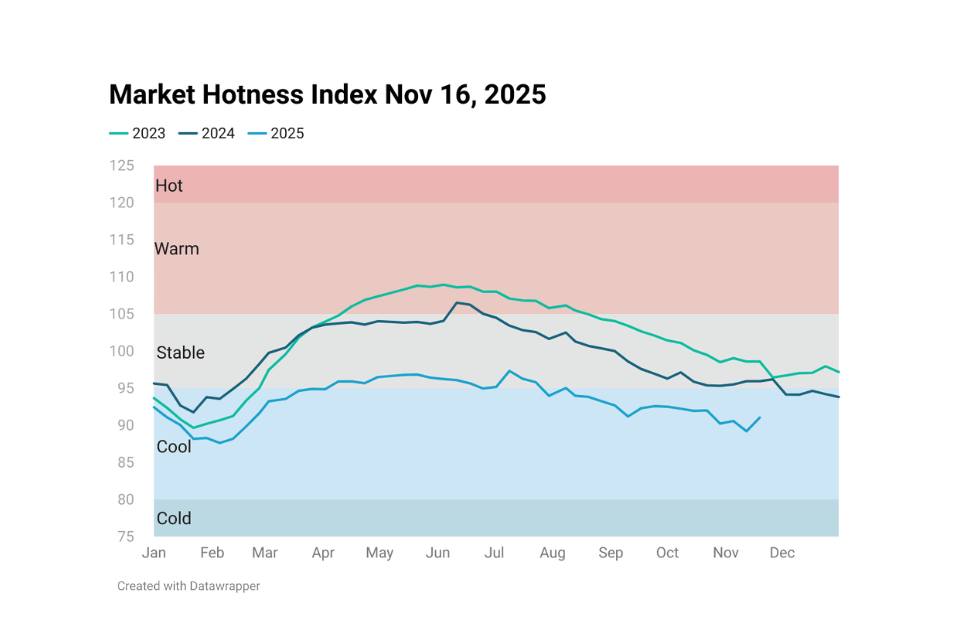

The U.S. Housing Market Hotness Index fell to 84.17 for the week ending February 8, 2026, signaling continued cooling in housing activity. Although mortgage rates are 80 basis points lower than a year ago, affordability remains strained as home prices stay elevated and labor market softness dampens buyer confidence.

Housing Market Hotness Index Feb 08, 2026 Read More »