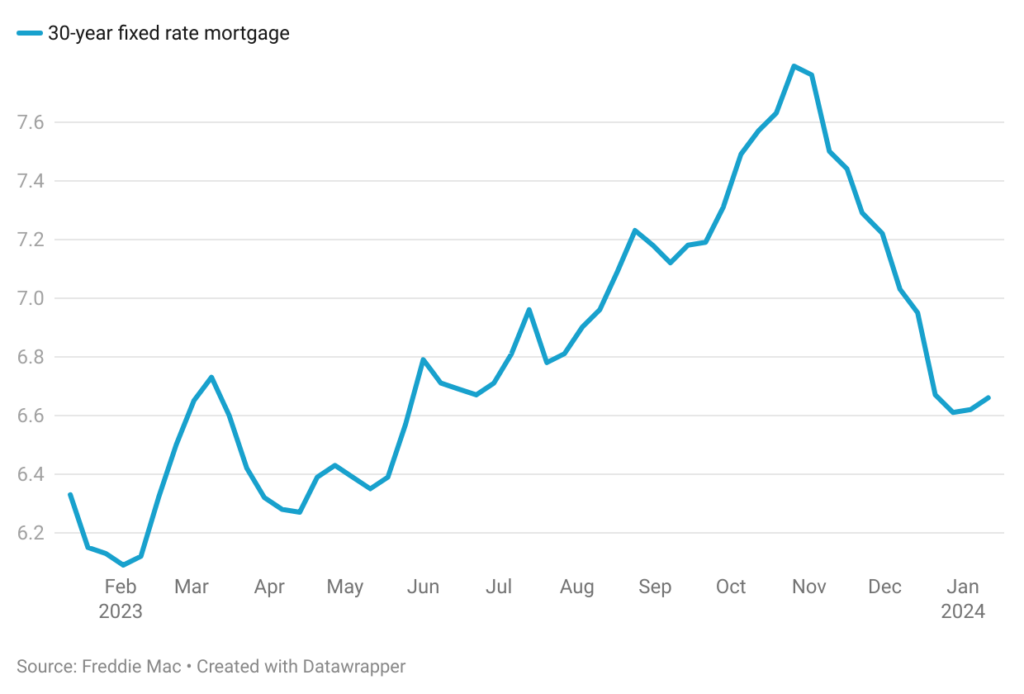

At 7.79% in October 2023, the 30-year fixed mortgage rate reached its highest level since 2001 according to Freddie Mac data, but since then it has been experiencing a downward trend. The rate was at 6.66% on Jan 11th, 2024, 33 basis points higher than its level a year ago. However, mortgage rates have been at the 6.6% level for the last four weeks as economic data continues to show a strong economy. This decline in rate since October is based on the belief that inflation has slowed down, and the Federal Reserve, which didn’t change rates in its last three meetings, might decide to cut interest rates this year. While the Fed does not directly set mortgage rates, its decisions have an impact on them. Typically, mortgage rates follow the yield on 10-year US Treasury bonds, which is influenced by the Fed’s actions, market expectations, and investor reactions.

The recent drop in mortgage rates has sparked heightened activity in the housing market, attracting more buyers and encouraging existing homeowners to consider refinancing. According to the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey, there was a notable 9.9% increase in mortgage applications for the week ending on January 5, 2024 compared to the previous week. Moreover, the Refinance Index saw a significant 19% surge from the prior week, marking a substantial 30% increase compared to the same week the previous year. With rates declining by more than 1% from October 2023 to January 2024, expected monthly mortgage payments are experiencing a reduction.

The question on everyone’s mind is whether the current lower mortgage rates will persist throughout 2024 or if they will start climbing again. According to Veros’ forecast, mortgage rates are projected to stay below 7%, fluctuating between 6.6% and 6.8% in the first quarter of 2024 and then gradually decreasing to 6.5% by the end of the year. The majority of forecasts do not foresee a dip below the 6% threshold. With inflation holding in the mid-3% range, exceeding the Fed’s 2% target rate, and unemployment staying below 4% while wages continue to grow, suggests that a substantial rate decline is unlikely. Many experts believe the Fed will not initiate rate reductions until mid-2024. Potential homebuyers, are however expected to respond positively to more favorable borrowing conditions.

The housing market of 2023 has been characterized by the lock-in effect, where current homeowners holding mortgage contracts with rates below 4% are hesitant to relinquish these agreements in favor of higher-rate contracts. These homeowners are unlikely to reenter the market unless compelled to do so given that mortgage rates are expected to stay above the 6% level. This group constitutes nearly 80% of all homeowners with mortgages. Consequently, the housing market is expected to maintain a state of low supply, potentially not as severe as observed in 2023, but still considerably below pre-pandemic levels.