For years, the mortgage industry fixated on the “rate lock” phenomenon. It was the main story of 2024 and 2025: homeowners stayed put to keep their 3% rates. However, as we move into 2026, a quieter, more direct risk is emerging for those holding Mortgage Servicing Rights (MSRs).

The industry is entering a phase we call the Default Drift. This is not a sudden 2008-style crash. It is a slow thinning of the equity cushion that has, until now, kept mortgage defaults fairly low.

When Home Values Stop Growing

The post-pandemic housing boom acted like a massive insurance policy. With home prices jumping nearly 40% in some areas, even borrowers in financial trouble could usually sell their way out of a default.

That “equity policy” is now running out. According to 2026 industry data:

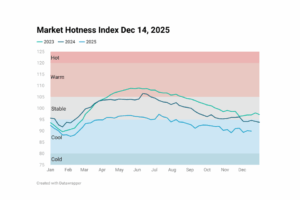

- Stalling Prices: The Mortgage Bankers Association (MBA) projects home price growth will flatten nationally, with some markets likely to see small price drops by late 2026 [1].

- Inflation is Eating Gains: Since the cost of living is rising faster than home values, the “real” value of homes in many cities is actually falling for the second year in a row.

- Low Growth Projections: S&P Global projects a modest 1.3% increase in the FHFA House Price Index through late 2026, well below the historical annual average of 5% [2].

The Hidden Cost of "Escrow Shock"

Equity doesn’t just disappear because prices stop rising. It also happens because the cost of owning the home is spiking. We are seeing a collision between flat property values and a massive surge in Taxes and Insurance (T&I).

Insurance premiums are no longer a minor expense; they are now a major reason why Debt-to-Income (DTI) ratios are expanding. According to the Urban Institute, the “all-in” cost of homeownership (specifically insurance and property taxes) has risen dramatically, with insurance costs now posing a threat to affordability and loan performance in several states [3]. When a borrower’s insurance bill jumps in a market where their home’s value is flat, their equity is being drained from their escrow account.

Some Ways to Get Ahead of the Drift

Managing an MSR portfolio in this environment requires moving from waiting for problems to actively seeking them out. If you wait for a 60-day delinquency report to flag a risk, you have already lost your chance to act.

- Test for “Escrow Stress”

Most risk models focus on interest rates but ignore insurance volatility. It may be a good idea for MSR holders to test their portfolios against localized tax and insurance hikes. If a premium spike pushes a borrower’s DTI above 45% in a ZIP code where prices are flat, that loan needs attention before the first payment is missed. - Using “Clean Up Calls” Strategically

2026 will be a big year for the secondary market, with roughly $65 billion in loans becoming eligible for clean-up calls [2]. This is a window for MSR holders to review underperforming pools and move away from collateral that is losing its equity buffer. VeroVALUE Portfolio automated valuation model (AVM) can help with home value insights to aid this assessment. - Meeting the New Compliance Rules

The CFPB AVM Quality Control Rule became mandatory in October 2025 [4]. While most firms focus on data accuracy, the 5th Factor – nondiscrimination – is also a priority. Servicers must ensure their models are fair and don’t create “disparate impact” as they tighten standards in response to local price stalls.

The Bottom Line

In 2026, the advantage will most likely go to the servicer with the clearest view of the property value underneath the loan. The Default Drift is a local, specific risk. Relying on national averages in this market is like flying without a map.

Heather Zeller

Heather Zeller, Senior Vice President of Marketing at Veros Real Estate Solutions (Veros) and Valligent, brings over 25 years of expertise in marketing, product strategy, and corporate growth across financial services, real estate, and fintech. With a strong foundation in Marketing, Economics, and Business, she drives brand innovation and market leadership.