With mortgage rates still elevated, housing inventory growing, and prices near historic highs, many Americans are asking: Is now the right time to buy a home—or should I wait? The answer depends on far more than just market headlines. Your personal finances, location, job security, and long-term goals all factor in.

In 2025, a smart homebuying decision requires balancing what you can afford today with what you might gain—or lose—by waiting. Below, we break down the key variables shaping this year’s market and offer a practical decision tree to guide your next step.

The Housing Market in 2025: What You Need to Know

Mortgage Rates: After peaking above 7% in mid -January, mortgage rates in 2025 have held above 6.6%, with only mild easing expected through year-end. Veros’ forecasts predict that mortgage rates will be around 6.5% by June 2026. The Federal Reserve is expected to remain cautious with rate cuts due to inflation remaining sticky and unemployment keeping low.

Home Prices: According to the Q2 2025 VeroFORECAST, home prices are projected to grow 2.2% from Q2 2025 to Q2 2026, down from previous double-digit gains, but still rising.

Inventory: While listings have improved slightly from 2023, supply remains below pre-pandemic norms, especially for starter homes and mid-tier properties. Many existing homeowners are “rate-locked,” hesitant to give up ultra-low mortgages they secured in 2020–2021.

Buyer Demand: The share of first-time buyers hit a 40-year low in early 2025, largely due to affordability constraints and down payment hurdles. However, cash buyers—especially baby boomers—remain active in many markets (NAR).

The 2025 Buy-or-Wait Decision Tree

Ask yourself the following to determine whether buying now or waiting is the smarter move:

Are You Financially Ready?

- YES: You have a stable income, emergency savings (3–6 months), and a manageable debt-to-income (DTI) ratio.

- NO: You’re relying heavily on credit cards or have no buffer for repairs or emergencies.

If YES, proceed.

If NO, wait and focus on financial strengthening.

Do You Have at Least 5%–10% for a Down Payment?

- YES: Plus, closing costs? Great—you’re ahead of many first-time buyers.

- NO: You may still qualify for FHA (3.5%) or VA (0%) loans but consider the long-term cost of PMI.

If YES, continue.

If NO, waiting to save more may reduce your monthly payment burden.

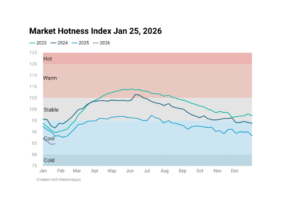

Is Your Housing Market Cooling or Heating Up?

- Cooling: Prices are flattening or declining slightly? You can take time to decide and find a good deal.

- Heating Up: Prices are climbing, and inventory is low? Expect more competition and stress.

If the market is cooling, you could buy now or wait.

If the market is heating, buying now could be wise, because prices are likely to go up further.

How Long Do You Plan to Stay?

- 5+ years: Buying often makes financial sense even if prices dip short-term.

- <5 years: Consider renting because high transaction costs (closing fees, commissions) may outweigh equity gains.

Long-term plans? Buy.

Short-term? Wait or rent.

Are You Trying to Time the Market?

- YES: Hoping prices or rates will fall soon? There’s no guarantee—and waiting can cost you in rent.

- NO: You are focused on what’s affordable and sustainable for you today.

Don’t try to “outsmart” the market. If you’re financially ready and plan to stay long-term, buying now may be smarter—even if conditions aren’t perfect.

The Risk of Waiting

Waiting to buy in 2025 might make sense if you expect your income to grow, mortgage rates to fall, or home prices to cool in your area. But it’s important to weigh that against:

- Rising rents

- Increasing home prices

- Potential rate volatility from global economic shifts

If prices rise just 4% and rates stay flat, a $400,000 home could cost $16,000 more by mid-2026—without any improvement in affordability.

Conclusion: Make the Market Personal

There’s no one-size-fits-all answer. But in 2025, the wisest homebuyers are focusing less on “perfect timing” and more on personal financial readiness and long-term planning.

If you’ve got the income stability, down payment, and plan to stay for a while, now might be the right time to move. If not, there’s no shame in waiting, saving, and watching the market.