The September employment report delivered what looked like a mixed message: employers added 119,000 jobs, yet the unemployment rate still edged higher. At first glance, those two trends seem contradictory. But when you break down how the labor market is measured, the picture becomes clearer and more revealing about the state of the economy.

A Solid Hiring Month That Didn’t Move the Needle on Joblessness

Payrolls expanded by roughly 119,000 positions in September, a pace that would normally indicate a steady, if not spectacular, job market. But the unemployment rate rose anyway, climbing to 4.4 percent. One reason for the mismatch could be that the unemployment rate is drawn from household responses, whereas job growth is tracked through employer data, and those surveys can diverge. Also, the key to understanding this lies not just in the number of jobs created, but also in the number of people counted as part of the labor force.

More People Looked for Work and That Changes the Math

The unemployment rate reflects workers who don’t have a job but are actively searching for one. In September, a large number of people entered the labor market such as young workers finishing school, people returning after caregiving breaks, and others who had been sidelined during earlier uncertainty.

When more individuals start looking for work, the unemployment rate can rise even if hiring is healthy. The Employment Situation report showed a 470,000 increase in the labor force, while the number of those employed increased by only 251,000, thus increasing the unemployment rate. So, while job growth was positive, it was not large enough to absorb the influx of jobseekers.

Underlying Weaknesses Are Still Present

Even though September’s headline job gains beat expectations, the broader labor picture is softer than it appears. Earlier employment estimates were revised lower, suggesting hiring momentum has cooled more than previously thought. After revisions, July’s job growth was reduced by 7,000, bringing the total down to 72,000. August’s number underwent a sharper correction, turning what was first reported as a 22,000-job increase into a loss of 4,000. Some industries including manufacturing and transportation shed workers, while gains were concentrated in a few service sectors. This uneven pattern means employers are adding jobs, but not across the board.

What This Means for the Housing Market

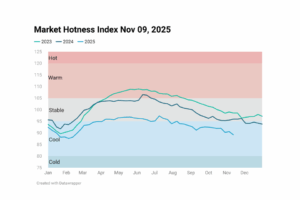

The sharpest pullback in job growth is occurring in high-income sectors such as professional and business services, with job losses in this segment totaling 62,000 from September 2024 to September 2025. These are the very workers most likely to qualify for today’s expensive mortgages, which is why their loss has an outsized impact on the housing market. With a median-priced home now requiring a six-figure annual income, which is far above what the typical household earns, shrinking employment in top-earning fields means fewer buyers can meet today’s borrowing thresholds.

As better-paid jobs disappear, growth is increasingly concentrated in lower-wage industries like education and health care, shifting demand toward rentals rather than home purchases. Markets where high-income hiring is cooling are seeing weaker buyer demand and softer home prices. As layoffs in tech and other high-paying fields continue, housing demand is tilting further toward rentals, and home prices in many metros may remain under pressure even without a traditional recession.