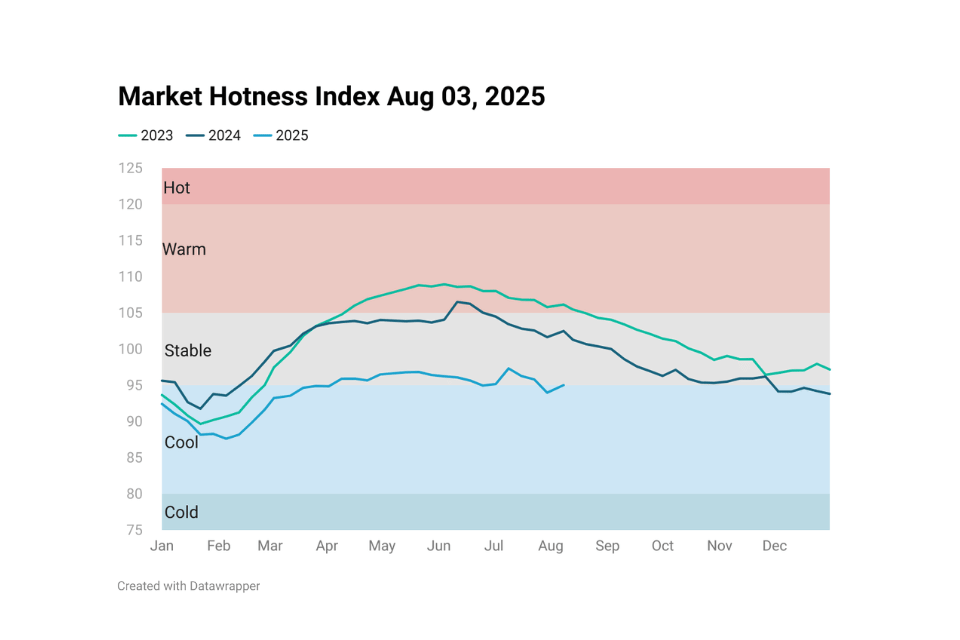

The U.S. Housing Market Hotness Index climbed to 95.02 for the week ending August 3, 2025, up from 93.97 the previous week, signaling a modest increase in buyer engagement. This slight uptick comes despite the broader market being stuck in a holding pattern for much of the summer due to persistently elevated mortgage rates. Last week brought some relief: the average 30-year fixed mortgage rate dipped to 6.62%, the lowest level in three months. There are growing expectations that the Federal Reserve will cut interest rates in September, potentially followed by one or more additional cuts before year-end. If realized, these rate reductions could provide a much-needed boost to the housing market by lowering borrowing costs and unlocking pent-up demand. However, there is an important caveat: a rate cut by the Fed would likely be triggered by a softening labor market—a development that could dampen consumer confidence and purchasing power.

On a regional level, the national numbers mask a growing divergence in market conditions. Several metropolitan areas in the Northeast continue to see brisk activity, supported by strong local economies and limited inventory. In contrast, markets in parts of Florida and Texas are showing signs of cooling, with weaker demand and elevated inventory.

*Index values are subject to revision as deemed necessary, contingent upon the receipt of new or updated data.