Will 2025 be the year affordability finally improves? Will we finally see a significant drop in mortgage rates? Will prices continue to climb, or could we see a shift? And what will happen to the inventory of homes available for sale? These are just a few of the questions as we look ahead to the new year.

Expectations for Mortgage rates and Home Prices

Mortgage rates did not fall below 6% in 2024 as many had expected because persistent inflation forced the Federal Reserve to implement fewer interest rate cuts than initially expected. The Fed has signaled that only a couple of rate cuts are likely in 2025, suggesting that mortgage rates will remain elevated. According to Veros’ forecast, mortgage rates are expected to reach approximately 6.6% by the end of 2025. This indicates that significant improvements in affordability are unlikely.

Despite these challenges, the housing market is expected to see modest price gains in 2025. While regional variations will undoubtedly exist, with some markets potentially experiencing price depreciation, a significant market crash is not anticipated. In fact, since 1975, average US house prices have experienced declines only during 2007-2011, highlighting the historical resilience of the housing market.

Housing Inventory

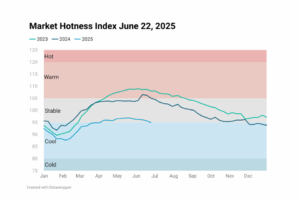

Housing inventory increased from 1.13 million homes in November 2023 to 1.33 million in November 2024, an 18% year-over-year rise (NAR). While this is a substantial increase, this growth is from a historically low base. Furthermore, the quality of this increased inventory is a concern. Many homes on the market have been listed for extended periods, suggesting either unrealistic pricing expectations or limited buyer appeal.

A significant factor limiting housing supply is the “lock-in effect.” Approximately 60% of homeowners currently hold mortgages with interest rates below 4%, making them reluctant to sell and incur significantly higher borrowing costs. Additionally, the aging population is increasingly opting to “age in place” rather than downsize, due to a lack of suitable and affordable housing options.

Given the expectation of persistently high mortgage rates, significant inventory growth is unlikely in 2025. This limited supply will continue to exert upward pressure on prices, making homeownership challenging for many.

Housing Demand

The combination of high mortgage rates and escalating home prices has priced out many first-time homebuyers, creating significant pent-up demand. This has led to innovative strategies among prospective buyers. Many are adapting by considering smaller properties, less desirable locations, or delaying their homeownership plans, increasing savings efforts for larger down payments to improve affordability, and exploring alternative options such as condos, townhomes, or other more affordable housing options.

A robust job market, characterized by strong wage growth and low unemployment, has significantly supported housing demand. Additionally, a buoyant stock market has provided a financial cushion for many potential homebuyers. While the labor market may experience some cooling, these underlying economic factors are expected to continue supporting demand in 2025.

New Construction

Homebuilders in the southern belt ramped up construction during the pandemic housing boom but are now facing challenges selling off their inventory. Facing softening demand, builders are increasingly resorting to offering incentives, such as lower-rate loans, to attract buyers. Moving forward, homebuilders will contend with elevated interest rates, high input costs, and potential labor shortages. Driven by affordability concerns, homebuilders are likely to prioritize smaller square footage in their new construction projects. By focusing on smaller, more efficient floor plans, builders can reduce construction costs and make homes more accessible to a wider range of buyers.

The 2025 housing market is poised for a period of continued, although more moderate, price growth according to Q4 2024 Veros projections. While some Sun Belt markets may experience a cooling, the Northeast and Midwest are projected to see stronger growth, driven in part by their relative affordability.