In September 2025, the Federal Reserve cut its target rate by 25 basis points, a move that many had anticipated. Since this policy pivot was expected, mortgage rates had fallen going into this news. After the rate cut, mortgage rates ticked up. That is because mortgage interest rates do not move in lockstep with the Fed’s federal funds rate; instead, they tend to track the yield on the 10-year U.S. Treasury, which reacts to inflation expectations, economic data, and investors’ confidence. Mortgage rates ticked back up after the rate cut as Treasury yields inched higher, reflecting shifting expectations about inflation and the broader economy. In part, this rebound reflects the market’s interpretation of the Fed’s forward guidance. In its accompanying statement, the Fed projected only two additional cuts for 2025 and one in 2026. That tempered optimism and likely encouraged bond investors to demand higher yields, especially if they felt inflation might remain sticky.

The Fed’s forward guidance reflected a more cautious stance than some market participants had anticipated. If investors had expected the Fed to pursue a more aggressive and prolonged series of cuts, long-term yields would likely have remained lower. However, signaling a slower pace suggested that inflation may prove more persistent, causing longer-term yields to move higher.

Weak Jobs & Inflation Tug the Fed in Opposite Directions

The Fed’s dual mandate to support maximum employment and stable prices has become harder to balance in recent months. Over the past few months, increasingly weak employment numbers have led to a shift in the Fed’s public stance on interest rates. August’s jobs report showed a paltry 22,000 jobs added, and prior months were revised downward, marking one of the weakest back-to-back readings in years. Even more alarming, the government reported that the U.S. lost 13,000 jobs in June, a rare contraction in recent memory. Meanwhile, private-sector employment contracted by 32,000 jobs in September, according to ADP.

These softening data points lend credence to arguments for further rate cuts. But inflation pressures remain persistent. If markets believe the Fed’s easing will re-accelerate demand (and inflation), they may bid up long-term yields to compensate. Further, it is expected that the impact of tariffs will keep inflation elevated at least over the next few months. Veros’s own outlook sees mortgage rates lingering near 6.3% through mid-2026, moving within a narrow range rather than dropping in any significant way.

Implications for the Housing Market

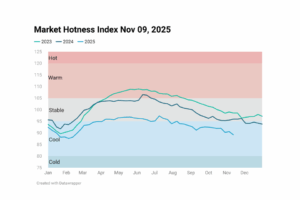

With mortgage rates unlikely to meaningfully retreat, the affordability squeeze continues. Home prices remain elevated in many markets, placing ownership out of reach for a large swath of buyers. The squeezed pool of qualified buyers, combined with economic uncertainties and weak job growth, means many households will delay or abandon plans to purchase a home.

On the supply side, many would-be sellers are trapped because they hold ultra-low mortgage rates from prior years and are unwilling to trade them for current loan terms. The result is a market that’s simultaneously stagnant on demand and restricted on supply.

The Fed’s September rate cut was expected and it has not unleashed any wave of homebuying activity. Combine that with weak labor data and persistent inflation fears, and the housing market outlook remains largely unchanged since affordability gains will be marginal at best, and many buyers will continue to sit on the sidelines unless a clearer economic improvement emerges.