From 2020 to 2022, home prices surged by over 40% in Florida and by more than 30% in Texas (FHFA). The sunbelt surged in popularity during the pandemic as remote work flexibility empowered residents to relocate freely. This, coupled with the allure of sunny weather, affordability, and potentially lower taxes, fueled a buying frenzy in these regions. But it seems that the housing boom of the pandemic years is drawing to a close in Florida and Texas.

The work from home landscape is shifting, although it is not entirely going away. The initial affordability advantage of these states has diminished. Home prices have skyrocketed, making it difficult for many to find a foothold in the market. Beyond the purchase price, ongoing expenses are adding up. In Florida, home insurance costs are surging, especially in hurricane-prone areas. Further, HOA fees have risen significantly in many locations. Hurricane Ian’s aftermath has flooded the market with damaged homes, further impacting availability and affordability. Obtaining flood insurance in these areas is becoming increasingly difficult and expensive. In Texas, property taxes are on the rise due to property reassessments reflecting the recent home price gains. Insurance costs have been soaring – the higher risk of extreme weather events and related higher damage claims have been driving up insurance premiums. As demand has slowed down, inventory is going up.

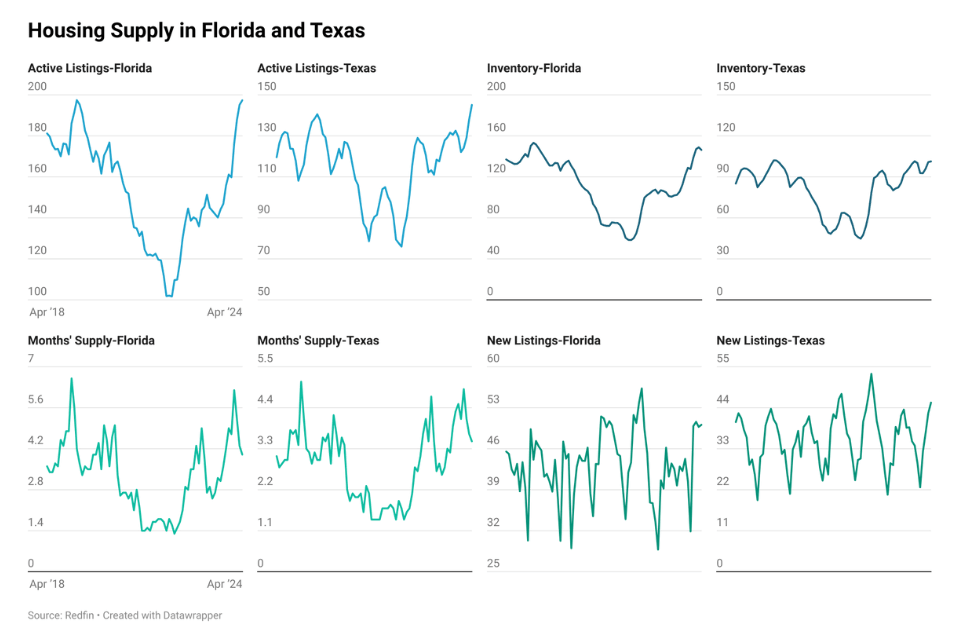

Data from Redfin indicates that inventory in both Florida and Texas has returned to pre-pandemic levels. In April 2024, Florida had a 4 months’ supply of housing inventory, similar to the 3.6 months in April 2018 and 3.7 months in April 2019. This contrasts with the significantly lower inventory levels during the pandemic boom, which were 1.4 months in April 2021 and 1.5 months in April 2022. Texas follows the same trend, with a 3.5-month supply in April 2024, compared to 3.1 months in April 2018 and 3.2 months in April 2019. During the pandemic years, the inventory levels in Texas were 1.4 months in April 2021 and 1.6 months in April 2022. In both states, active listings, new listings, and inventory have climbed up significantly compared to the levels in 2021 and 2022 and are now at pre-pandemic levels.

Besides the slow down in demand, inventory has been going up because new supply has entered the market. Over the past five years, Texas and Florida have consistently ranked 1st and 2nd in the number of building permits issued. Both states have seen a significant increase in new homes, which are now lingering on the market as high home prices and mortgage rates deter buyers from rushing in. Additionally, the influx of out-of-state buyers has significantly decreased. Almost a third of active listings have price drops according to Redfin data, indicating that buyers now have more leverage in these markets. According to VeroFORECASTSM, prices are expected to remain flat in Texas from Q1 2024 to Q1 2025, with less than a 2% increase anticipated in Florida.