Beyond the Coasts: Midwest Markets Gain Investor Attention

A compelling narrative is gaining momentum in the American Midwest. It presents significant opportunities for wise investors seeking robust returns and long-term stability as we navigate 2025. While coastal states have traditionally held the lion’s share of housing investment attention, dynamic markets like Detroit, Michigan; St. Louis, Missouri; Cleveland, Ohio; and Pittsburgh, Pennsylvania, are increasingly capturing interest. Offering a more accessible entry point than their Pacific and Atlantic counterparts, these Midwestern hubs boast appealing affordability, evolving economies, and an improving quality of life.

The data and trends observed in the first half of 2025 illuminate a positive shift ripe for exploration when considering strategic capital deployment. For investors looking to broaden their horizons beyond the often mature and higher-priced coastal markets, the promising potential of the Midwest warrants a closer, enthusiastic look.

The Invigorating Appeal of Affordability for Investors

A key element of the Midwest’s growing allure is its remarkable affordability, a particularly advantageous factor in the current interest rate environment. While real estate in many coastal states commands premium prices, the median home price in major Midwestern metropolitan areas offers a more attractive entry point compared to national averages. For instance, as of Q1 2025, the median existing home sales price in the Midwest was approximately $280,000, presenting a compelling value proposition compared to the $550,000 median in the West, as the National Association of Realtors. Consider the advantageous comparison of median home prices in more specific regions as shown below.

Comparative Median Home Prices (Q1 2025)

This chart compares the median sale prices of homes in selected Coastal and Midwest cities for Q1 2025.

| CITY | REGION | MEDIAN HOME PRICE |

|---|---|---|

| San Jose, CA | Coastal | $1,920,000 |

| Anaheim-Santa Ana-Irvine, CA | Coastal | $1,360,000 |

| San Francisco, CA | Coastal | $1,315,600 |

| San Diego, CA | Coastal | $985,000 |

| Los Angeles, CA | Coastal | $939,700 |

| Toledo, OH | Midwest | $235,000 |

| Cleveland, OH | Midwest | $179,000 |

| Peoria, IL | Midwest | $172,400 |

| Decatur, IL | Midwest | $135,100 |

| Source: National Association of Realtors | ||

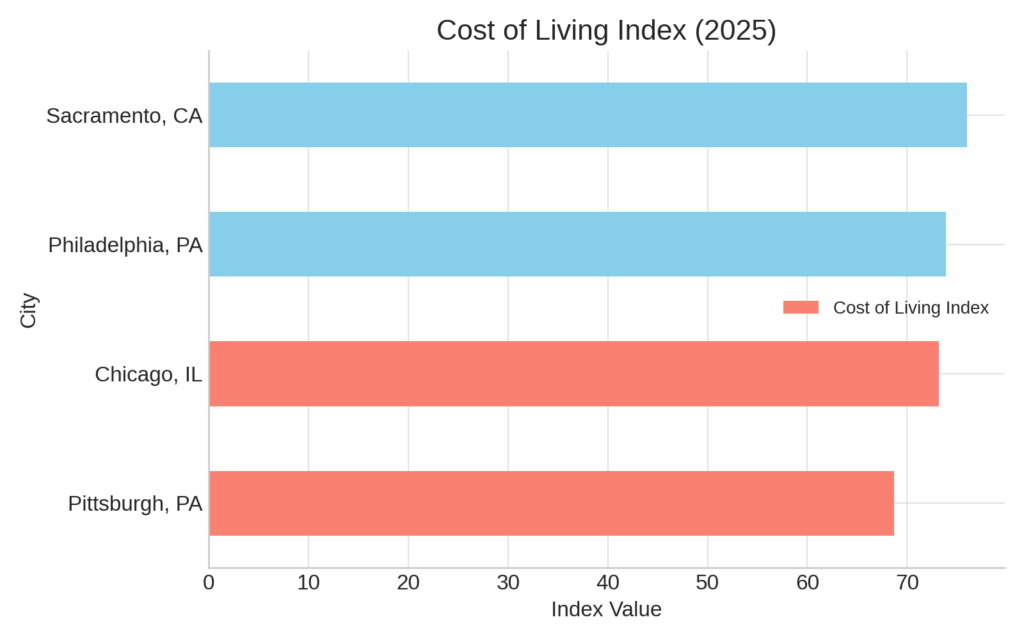

Cost of Living Index (2025)

This chart presents the cost-of-living index scores for selected Coastal and Midwest cities in 2025.

| CITY | REGION | COST OF LIVING INDEX |

|---|---|---|

| Chicago, IL | Midwest | 73.2 |

| Pittsburgh, PA | Midwest | 68.7 |

| Sacramento, CA | Coastal | 76.0 |

| Philadelphia, PA | Coastal | 73.9 |

| Source: Numbeo | ||

The Midwest Magnet: Sustained Investor Interest

The story of the Midwest as an attractive investment destination gained significant momentum in early 2024, and current data indicates this trend has continued into 2025. The July 2024 Realtor.com® report highlighted a notable increase in investor activity, particularly in Missouri. During the first quarter of 2024, Springfield, Kansas City, and St. Louis all ranked among the top markets nationwide for investor share, with Springfield leading at nearly 20% of all home purchases.

Building on this, trends observed in early 2025 further underscore the Midwest’s appeal. Reports indicate that home prices have been rising rapidly in many Midwestern markets, with Redfin noting significant year-over-year increases in cities like Milwaukee and Detroit as of February 2025. This price appreciation, combined with the region’s relative affordability compared to coastal areas, continues to draw investor interest. Moreover, the cost of living in the Midwest remains attractive, as highlighted in the April 2025 Wall Street Journal/Realtor.com Housing Market Ranking, further enhancing its appeal to both residents and potential tenants.

While national housing inventory has seen increases, the Midwest has experienced more moderate growth, suggesting a less saturated market. Furthermore, even amidst some national cooling in pending home sales, select Midwestern metros showed resilience in early 2025. This combination of affordability, rising prices in some areas, and relatively stable demand positions the Midwest as a region offering compelling opportunities for real estate investors in 2025.

Economic Diversification Fuels Investment Growth

- Detroit: According to a 2025 report by TechTown Detroit, Detroit’s technology sector is demonstrating impressive momentum, with a 12% increase in tech jobs over the past three years. The city’s economy is projected for growth, with anticipated wage increases for residents. The housing market is gaining notable traction, with rising home values and increased buyer engagement.

- St. Louis: St. Louis’s robust bioscience industry, anchored by significant expansions from institutions like BJC HealthCare, is creating a dynamic economic landscape. The real estate market is displaying resilience and steady growth, with median home prices trending upward.

- Cleveland: As shared by the Greater Cleveland Partnership, Cleveland’s consistent growth in advanced manufacturing, coupled with its nationally recognized healthcare system centered around the Cleveland Clinic, is fostering a stable and increasingly attractive housing market. Cleveland’s multifamily market is well-positioned for continued solid performance, supported by a healthy balance of supply and demand.

- Pittsburgh: Noted by the Pittsburgh Regional Alliance, Pittsburgh’s thriving technology and education ecosystem, energized by esteemed institutions like Carnegie Mellon University, is contributing to an increasingly stable and promising housing market. Pittsburgh’s tech scene is experiencing exciting growth, particularly in the AI and robotics sectors.

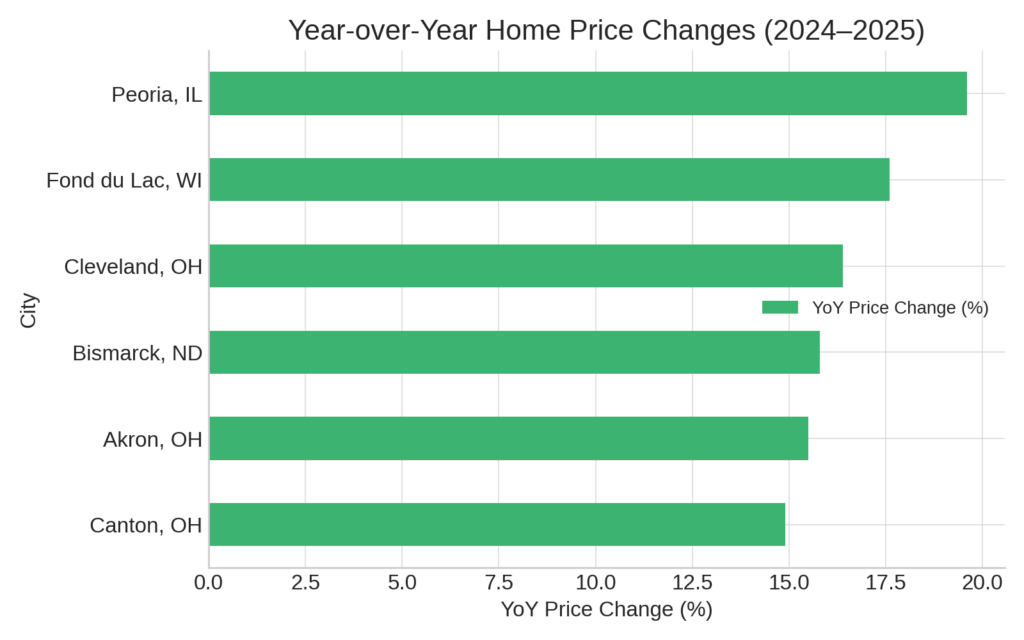

Year-over-Year Home Price Changes (2024–2025)

This chart displays the year-over-year percentage change in median home prices for selected Midwest cities.

| CITY | YOY PRICE CHANGE | |

|---|---|---|

| Peoria, IL | +19.6% | |

| Fond du Lac, WI | +17.6% | |

| Cleveland, OH | +16.4% | |

| Akron, OH | +15.5% | |

| Canton, OH | +14.9% | |

| Bismarck, ND | +15.8% | |

| Source: National Association of Realtors | ||

Climate Resilience Offers Enduring Investment Security

Considering the growing focus on climate resilience in investment decisions, the Midwest’s inherent climate resilience presents a significant long-term advantage for investors in 2025. While coastal states are navigating growing concerns related to rising sea levels, more frequent extreme weather events, and water resource management, the Midwest generally benefits from more stable climate patterns. This offers a valuable degree of long-term security for real estate investments, potentially mitigating risks associated with climate-related disruptions and insurance cost increases that may influence coastal properties.

Strategic Investment Opportunities Emerge in the 2025 Housing Market

- Capitalize on Attractive Valuations: The affordability difference between the Midwest and the often premium-priced coastal markets presents exciting opportunities to acquire assets with strong income-generating potential and promising appreciation prospects as these regional economies maintain their positive momentum.

- Diversify Portfolios for Enhanced Stability: Strategically allocating capital to the Midwest in 2025 offers valuable geographic diversification, which can contribute to a well-balanced risk profile and potentially enhance overall portfolio performance compared to concentrating solely in potentially more volatile coastal markets.

- Target Growing Employment Centers: Focusing on housing that serves the expanding workforces in key Midwestern industries, such as the projected 8% growth in healthcare jobs in St. Louis by 2027 (according to the St. Louis Economic Development Partnership), positions investments for sustained and increasing demand.

- Recognize Long-Term Appreciation Potential: As these regional economies continue their positive trajectories and attract residents seeking an appealing balance of affordability and quality of life, well-located properties in these Midwestern markets offer a promising outlook for steady and sustainable long-term appreciation.

For Investors Seeking Portfolio Enrichment Beyond Coastal Markets

For investors considering enriching their portfolios beyond the often competitive and expensive housing markets along the Pacific or Atlantic coasts, the Midwest offers a truly attractive alternative. By thoughtfully allocating a portion of your portfolio to these more affordable and increasingly vibrant markets, you can potentially achieve more favorable cash flow, contribute to a more resilient risk profile, and tap into growth areas with distinct economic drivers. The comparatively accessible cost of entry can also enable the acquisition of a greater number of units or properties for a similar initial investment compared to many coastal markets.

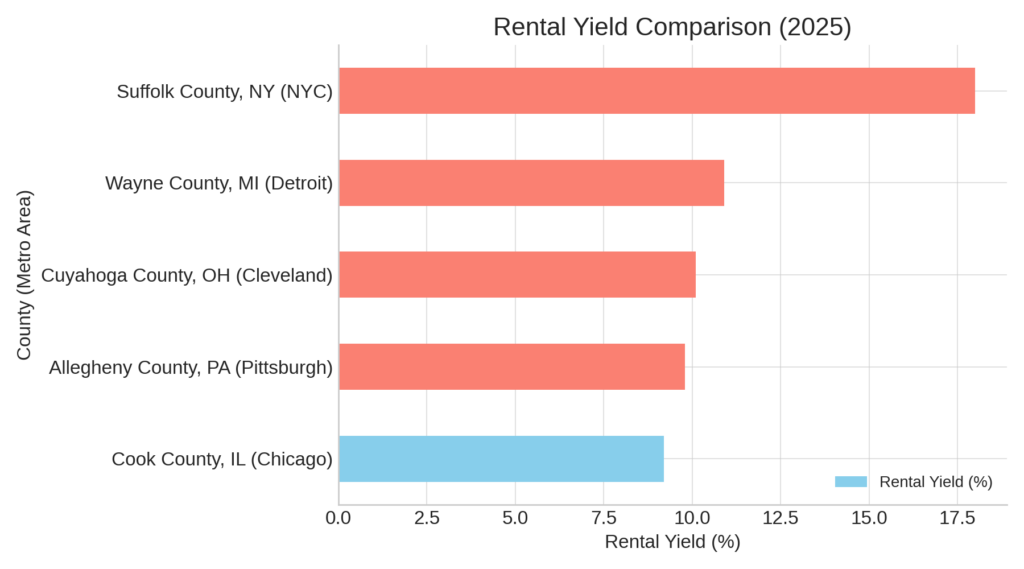

The advantageous rental yield comparison further underscores this opportunity.

Rental Yield Comparison (2025)

This chart compares the average rental yields in selected Coastal, Midwest, and Mid-Atlantic counties.

| CITY | REGION | RENTAL YIELD |

|---|---|---|

| Suffolk County, NY (NYC) | Coastal | 18.0% |

| Wayne County, MI (Detroit) | Midwest | 10.9% |

| Cuyahoga County, OH (Cleveland) | Midwest | 10.1% |

| Allegheny County, PA (Pittsburgh) | Mid-Atlantic | 9.8% |

| Cook County, IL (Chicago) | Midwest | 9.2% |

| Source: ATTOM Data Solutions | ||

Wrapping it Up

As we move forward through 2025, the American Midwest presents an exciting and increasingly positive narrative for strategic real estate investment, offering a refreshing and promising alternative to the often-analyzed coastal markets. The advantageous combination of appealing affordability, diversifying, and strengthening economies, and the inherent stability of the region positions Detroit, Michigan; St. Louis, Missouri; Cleveland, Ohio; and Pittsburgh, Pennsylvania, as promising destinations for investors seeking robust returns and long-term growth. It is an opportune time to look beyond the coasts and recognize the burgeoning opportunities in the heartland of America as we navigate the dynamic investment landscape of 2025.

Heather Zeller

Heather Zeller, Senior Vice President of Marketing at Veros Real Estate Solutions (Veros) and Valligent, brings over 25 years of expertise in marketing, product strategy, and corporate growth across financial services, real estate, and fintech. With a strong foundation in Marketing, Economics, and Business, she drives brand innovation and market leadership.