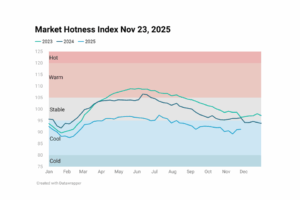

Veros has released its Q3 2025 VeroFORECAST, projecting a nationwide home price appreciation of 1.8% over the next 12 months. The outlook underscores a housing market caught in a delicate balance—cool demand, constrained supply, and regional disparities shaping performance across the country.

Despite mortgage rates easing to 6.3% following a Federal Reserve rate cut, affordability remains a major obstacle. Home prices are still 50% higher than at the start of the decade, and a weakening labor market that is discouraging many would-be buyers. Existing home sales hover near 4 million units annually, well below pre-pandemic levels.

On the supply side, inventory is improving but remains tight. Many homeowners are reluctant to sell due to low locked-in mortgage rates, while new construction continues to lag amid high material costs and labor shortages. Demographic trends compound the issue as baby boomers are staying put, keeping a significant share of homes off the market.

Regional trends reveal stark contrasts. The Northeast and Midwest are seeing stable demand and price growth, thanks to affordability and resilient local economies. In contrast, Florida and Texas are experiencing cooling conditions, with oversupply, high insurance costs, and affordability challenges leading to price declines.

While national growth remains muted, smaller, affordable metros in the Midwest and Northeast continue to outperform, highlighting a shift away from overheated Sunbelt markets.

Read the full Q3 2025 VeroFORECAST report for deeper insights into market fundamentals and regional dynamics.