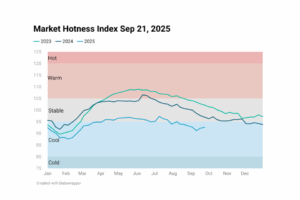

The U.S. Housing Market Hotness Index edged up to 92.29 from 91.18 the previous week, signaling only a modest shift in market activity. Mortgage rates are now at an 11-month low, yet this decline has not sparked a significant pickup in housing demand. For some buyers, the lower rates may provide just enough incentive to enter the market, but for many, affordability remains a major barrier as home prices stay elevated. Sellers may benefit from a slightly larger pool of qualified buyers and more offers, but accurate pricing remains essential. The Federal Reserve’s recent rate cut, prompted by a weakening labor market, offers limited relief. Economic uncertainty and softening employment trends are weighing on consumer sentiment and will likely keep the market in a “cool” zone for the foreseeable future.

Florida metros continue to rank among the weakest markets, with high months’ supply and longer selling times, compounded by rising insurance costs and property taxes. Northeast and Midwest regions remain among the hottest, driven by low inventory, relatively affordable prices, and quicker sales compared to many Sunbelt markets.

*Index values are subject to revision as deemed necessary, contingent upon the receipt of new or updated data.