How Affordability Is Drawing the Housing Map in 2026

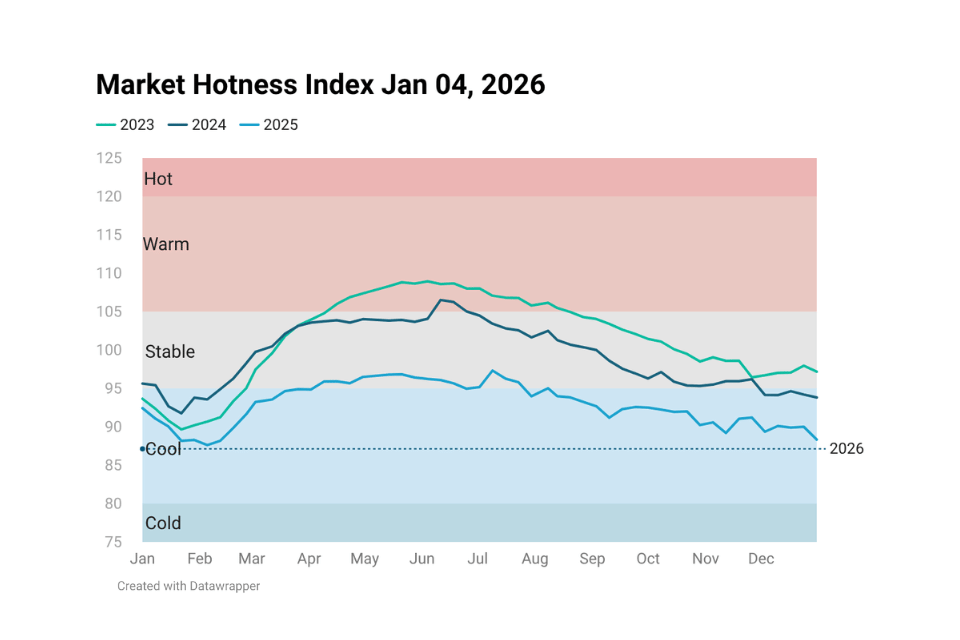

The U.S. housing market is becoming increasingly regional as 2026 approaches. While affordability and steady demand are supporting several Midwest and Northeast metros, many Sun Belt markets are grappling with slowing prices after years of rapid growth. Understanding local supply, demand, and affordability conditions is now essential for buyers, sellers, and investors alike

How Affordability Is Drawing the Housing Map in 2026 Read More »