Insufficient housing supply in America is a key driver behind the continual rise in home prices and the persistent low inventory. According to Freddie Mac’s® data, there was a supply deficit of 3.8 million units in Q4 2020. Other estimates also indicate deficits in the millions. With a growing population and the formation of more households, demand is on the rise. To address this, increasing the housing supply through new construction is essential. However, the construction of new homes has significantly lagged the growing demand.

Trends in building permits and housing starts are good forward-looking indicators of what is to come in the housing market. Building permits offer an estimation of the government-authorized new housing units each month. This activity serves as an indicator of housing and broader economic trends in the months to come. Housing starts gauge builders’ readiness to invest resources in new projects, reflecting their assessments of housing demand. This trend in starts can provide insights into risk appetite and consumer sentiment. Additionally, housing starts have a ripple effect on the growth of various industries, including banking, construction, and real estate. As the number of housing starts rises, it indicates that more housing inventory can be expected in the future. This is positive news for buyers who have grappled with a pronounced shortage of available existing homes.

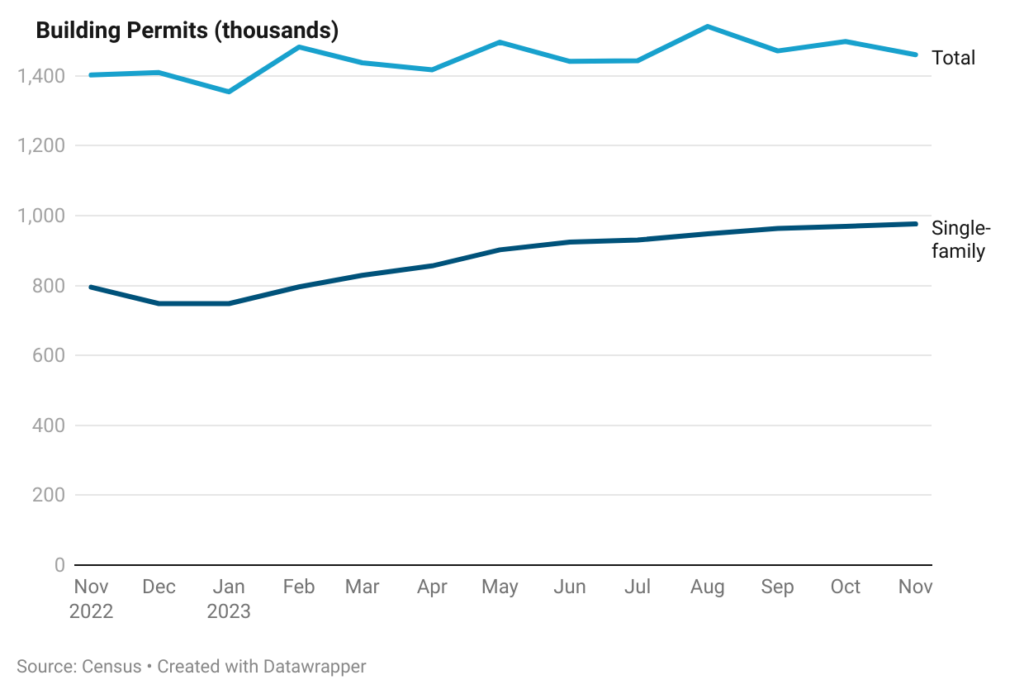

Building Permits

In November 2023, privately-owned housing units authorized by building permits were at a seasonally adjusted annual rate of 1,460,000. This represents a 4.1% gain compared to a year earlier. In comparison, single-family permits increased by nearly 23% compared to a year ago. Permits declined y-o-y in both the northeast and Midwest, showed a slight appreciation in the south, but increased 33% in the west. Permits for single-family homes logged y-o-y gains in all regions, with the highest in the west.

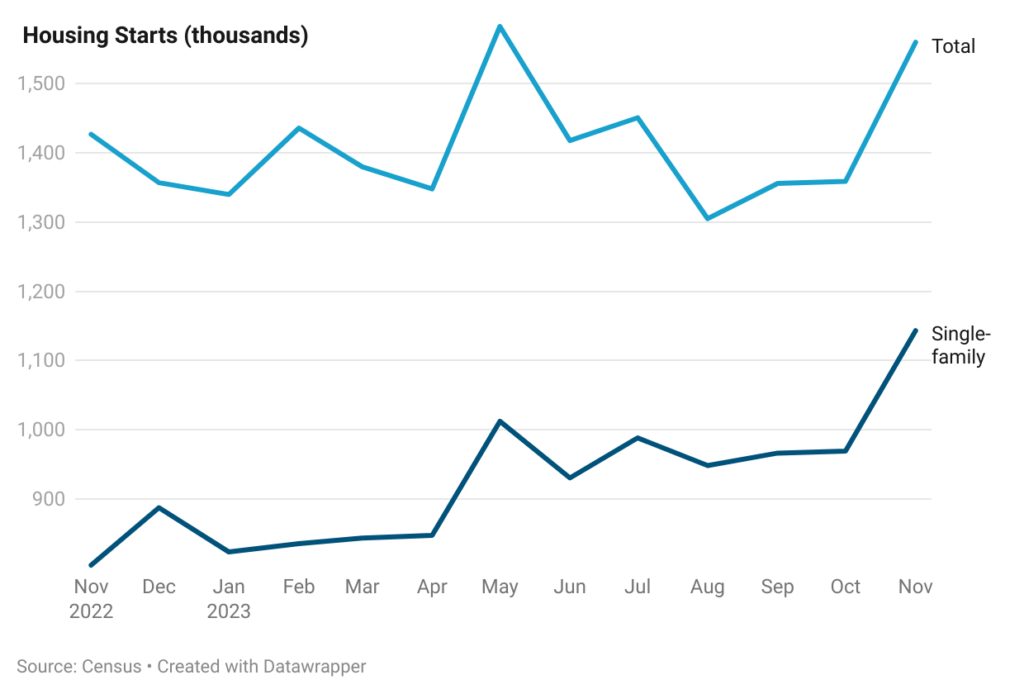

Housing Starts

The most recent Census data shows that the seasonally adjusted annual rate of all housing starts was 1.56 million in November 2023, an increase of 9.3% from a year earlier, and at the highest level since May. In comparison single-family housing starts increased by 42.2%. Lower interest rates and a lack of resale inventory are helping to provide a strong boost for new home construction. Housing starts showed the highest y-o-y appreciation in the northeast at 67%, followed by a 13% gain in the south. The other two regions – the Midwest and west recorded y-o-y declines. However, all four regions registered strong y-o-y gains in the single-family segment.

Housing starts showed stronger growth compared to permits, especially in the single-family segment. The single-family segment has recorded a strong showing in all four regions as well. These statistics indicate that investors are constructing new homes due to an insufficient supply of single-family homes to meet the increasing demand for single-family properties. While this is good sign for the housing market and homebuyers looking to buy homes, it is not enough to ease the low supply any time soon.