Feeling the pressure in the 2025 short-term rental market? You’re not alone! This year is shaping up to be a pivotal one, requiring you to navigate shifting dynamics, regulatory pressures, and evolving guest expectations to not just survive, but thrive in a more balanced yet competitive landscape. In this post, let’s take a look at the key trends and data shaping the STR industry this year and uncover what you can do to not just remain competitive, but gain an edge in an increasingly complex market.

Market Dynamics: Supply, Demand, and Competition

Remember the boom years? Well, the rapid expansion of STR supply is now hitting the brakes. According to AirDNA, supply is expected to increase by just 4.7% in 2025, with further deceleration likely in 2026. High interest rates and sustained inflation—projected to hover slightly above the Fed’s 2% target— are significantly limiting new housing transactions and constrain inventory growth through mid-2025.

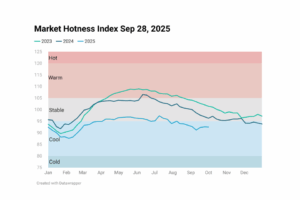

The good news? Demand continues to be a powerful engine for the STR market. AirDNA reports that demand surged +7.0% year-over-year in 2024, with occupancy rebounding close to 2023 levels by October. This momentum is expected to stabilize occupancy rates around 54.9% by the end of 2025—more in line with pre-pandemic norms.

Here’s where things get interesting: the fight for bookings is fiercer than ever. In a Hostaway survey, 76% of respondents cited increased competition in 2024. Guesty reports that 55% of operators now see market saturation as a top concern. According to Hotel News Resource, roughly one in four hosts has stopped renting at least one property in the past year—either temporarily or permanently. Are you feeling the squeeze?

Despite this intense competition, significant opportunities still exist. AirDNA U.S. Short-Term Rental Industry Outlook projects a 2.9% rise in Revenue Per Available Room (RevPAR), supported by year-over-year increases in Average Daily Rates (ADR). Meanwhile, Statista estimates U.S. STR revenue will reach $21.08 billion in 2025, with a 4.12% CAGR through 2029—amounting to $24.78 billion by the end of the decade. To truly capitalize on this potential and secure healthy profits, strategic, tech-driven pricing and lean operational practices will be crucial.

Regulatory and Financial Pressures

Short-term rental regulations continue to evolve rapidly and vary widely across jurisdictions. Cities like New York, Washington D.C., San Francisco, and Atlanta are at the forefront of imposing stricter controls on short-term rentals—driven by housing availability, neighborhood disruption, and tax compliance concerns. Staying ahead of these changes is no longer optional; it’s essential.

New York City’s enforcement of Local Law 18, which effectively bans many STRs, is among the most sweeping. Washington D.C. enforces licensing and rental day limits (Department of Consumer and Regulatory Affairs). while San Francisco mandates registration and imposes caps on short-term rental days (San Francisco Office of Short-Term Rentals). Atlanta requires STR operators to obtain licenses (City of Atlanta), and several states—including Florida, Colorado, and Massachusetts—are considering further restrictions. These changes are shrinking inventory in urban areas and driving up compliance costs for operators.

For many dedicated STR hosts, the reality is that financial pressures are significantly escalating. The persistent rise in inflation and operating costs is undeniably squeezing profit margins, creating a more challenging environment to navigate. According to Hotel News Resource, only 45% of STR hosts are primarily profit-motivated, while 28% rent to offset mortgage costs, and 27% aim to cover their expenses entirely via STR income. Are rising costs impacting your bottom line?

The 2024 State of the Short-Term Rental Industry Report by Rent Responsibly found that nearly one in four STR owners reported no profit or even losses. Meanwhile, 44.1% of owners derived 41% or more of their income from STRs, and nearly half made less than $25,000 in profit. Cleaning costs have also increased, adding to the financial burdens.

Guest Experience and Evolving Preferences

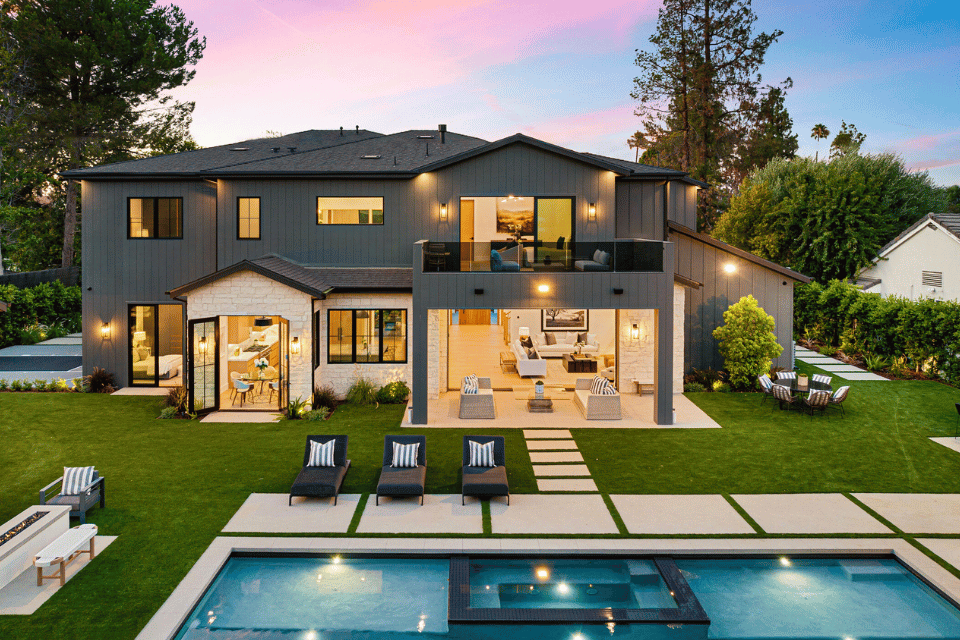

Let’s face it, simply offering a clean bed and a decent rating isn’t enough anymore. Travelers today are looking for personalized, experience-rich stays that stand out from the norm. AirDNA highlights the growing demand for unique, larger vacation rentals that offer comfort and character. Think beyond the basics!

Sustainability, convenience, and flexibility also rank high. Rent Responsibly found that 67% of guests prefer self-check-in, underscoring the importance of tech-enabled convenience. Guests increasingly expect well-designed, functional spaces stocked with premium amenities, emphasizing the need for an elevated, guest-first approach.

Tech Adoption and Future STR Operations

As competition grows and margins tighten, technology is rapidly becoming your secret weapon for efficient STR operations. According to Rent Responsibly, over 70% of STR operators now use artificial intelligence (AI), particularly for dynamic pricing, guest communication, and automation. Are you leveraging the power of AI?

The push toward direct booking platforms is also gaining steam. These platforms offer hosts a way to reduce reliance on costly online travel agencies (OTAs) and build brand loyalty. Smart home technologies—from keyless entry to smart thermostats—are further streamlining the guest experience while lowering labor and energy costs.

These tech-forward strategies are fast becoming the norm, separating professional operators from the rest.

Impact of Recent STR Policies on Local Housing Markets

Recent short-term rental (STR) policies are significantly impacting local housing markets, sparking debate as regulations increase due to concerns about exacerbating housing shortages and affordability crises. Maui exemplifies this interplay. Facing a pre-existing housing shortage compounded by devastating wildfires, a policy to curb STRs was proposed, potentially increasing long-term housing stock by an estimated 13%. While beneficial for housing, this could harm Maui’s vital tourism sector. Similarly, Utah sees conversions of long-term housing into STRs, reducing affordable options for the local workforce and driving up rental prices.

Academic research indicates a correlation between increased STR listings and rising rental rates and housing prices, the “Airbnb effect.” However, this impact isn’t uniform. While some studies show a modest general effect, high-demand tourist areas experience a more pronounced impact. Furthermore, broader issues like limited development and construction costs can overshadow the influence of STRs.

Regulatory responses vary widely, from caps and zoning restrictions to outright bans, as seen in Santa Monica, California. Despite stringent regulations leading to fewer STR listings, a significant decline in residential rents didn’t necessarily follow, suggesting other substantial factors influence housing costs.

Ultimately, the impact of STRs on housing is highly localized, depending on STR density, overall housing supply, local economic conditions, and specific regulations. Balancing the tourism sector with the need for sustainable and affordable housing for local communities remains a critical challenge.

Staying Ahead in the STR Market

Success in the 2025 STR market will depend on an operator’s ability to adapt to the evolving landscape, embrace strategic innovation, and maintain a deep understanding of the shifting market dynamics. Those who prioritize data-driven decision-making, skillfully navigate the complexities of regulatory compliance, deliver exceptional guest experiences, and effectively leverage technological advancements will be best positioned to capitalize on potential growth opportunities. In essence, to thrive in this demanding industry, swift adaptation and a proactive approach are no longer optional—they’re your keys to unlocking success.

Looking Ahead: The professionalization of the STR market is likely to continue, with increasing emphasis on data analytics, sustainability practices, and community engagement. Operators who proactively address these evolving demands will not only weather the changes but also carve out a successful and sustainable future in this dynamic and increasingly scrutinized industry. What steps will you take today to level up your STR strategy for 2025 and beyond?

Heather Zeller

Heather Zeller, Vice President of Marketing at Veros Real Estate Solutions (Veros) and Valligent, brings over 25 years of expertise in marketing, product strategy, and corporate growth across financial services, real estate, and fintech. With a strong foundation in Marketing, Economics, and Business, she drives brand innovation and market leadership.