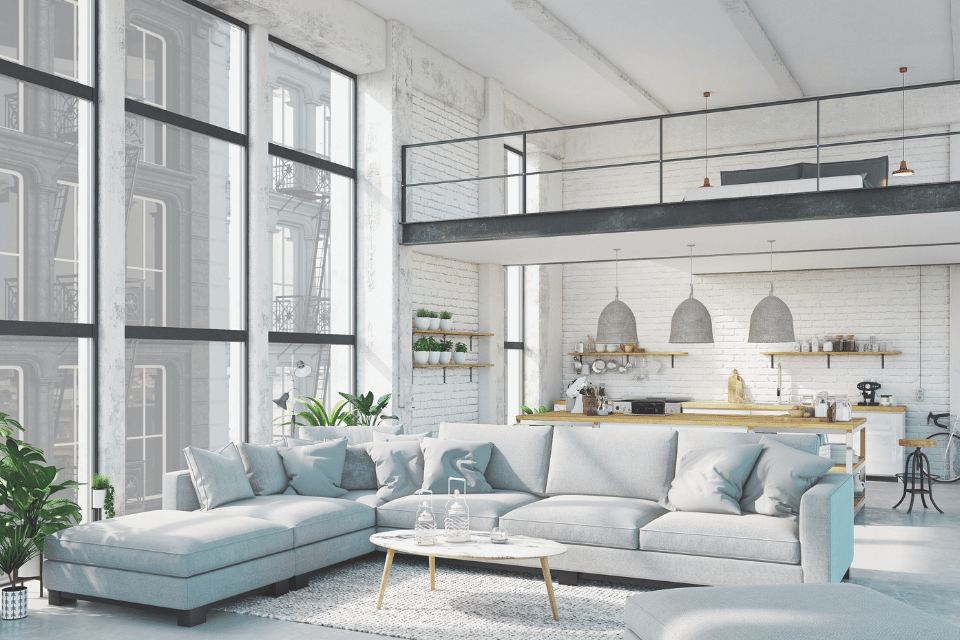

The skyline’s shifting. In 2025, the buzz isn’t just about business deals but about blueprints transforming vacant office towers into thriving residential hubs. Forget cubicles; look and find sunny lofts and community spaces where water coolers and break rooms once stood. This isn’t a futuristic concept; it’s the reality of a housing market grappling with a supply squeeze and the lingering echoes of hybrid and remote work.

Take a look at the numbers – they paint a clear picture. A staggering 71,000 new residential units are projected to spring from converted office buildings this year, a large leap from 23,100 in 2022, per the RentCafe. This 28% year-over-year pipeline growth signals a tectonic shift in urban development, with nearly 42% of all adaptive reuse projects nationwide now focused on office conversions (CommercialEdge National Office Market Report, Q1 2025). New York, D.C., Los Angeles, Chicago, and Dallas lead the charge, with combined conversion projects exceeding 25,000 units, reshaping their downtown cores. Notably, a significant 35% of these office-to-residential conversions are targeting buildings built between 1995 and 2010, highlighting the trend’s expansion beyond older, historically significant structures (RentCafe Blog).

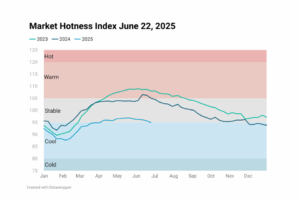

Why the sudden transformation? Simple: we need homes. The national apartment vacancy rate has dropped from 6.8 percent to 3.8 percent year-over-year in major urban centers (Apartment List National Rent Report, April 2025), and with office vacancy rates hovering around 24% and over (Statista, Office vacancy rates in the U.S. 2017-2024), developers see opportunity. Plus, cities are incentivizing these projects. For instance, New York City’s “Office Conversion Accelerator” program has already fast-tracked approvals for over 5,000 units (New York City Department of City Planning, Office Conversion Accelerator Program), recognizing their potential to revitalize downtowns and create 24/7 communities.

But it’s not all sunshine and renovated penthouses. Challenges are certainly present. Deep floor plates, limited window access, and complex plumbing and HVAC systems are driving up conversion costs by an average of 20% compared to new construction (Yardi Matrix Construction Cost Analysis, Q4 2024), making these conversions a logistical puzzle. And while increased supply is a boon, initial prices often cater to the higher end of the market, with the average rent in converted buildings exceeding the city’s median by 15-20% (Zillow Rental Market Data, March 2025), leaving affordability a lingering concern.

Lenders are adapting and exploring new financing models for these complex projects, and governments are offering loan guarantees to grease the wheels. The Federal Housing Administration’s “Adaptive Reuse Loan Guarantee” program has committed over $2 billion in funding this year alone (Federal Housing Administration, “Adaptive Reuse Loan Guarantee Program Report,” April 2025). Property values are a mixed bag; conversions can revitalize neighborhoods, with some converted buildings seeing a 30% increase in assessed value (Old Republic Title, March 2024), but overdevelopment risks creating a housing glut. It is likely that renters stand to gain the most, with a potential influx of new, unique living spaces in prime locations. However, the initial high rental rates are causing concerns and could create various limitations to access.

The question remains: can this trend truly address the affordability crisis? While conversions alone won’t solve the problem, they’re a vital piece of the puzzle. They breathe new life into underutilized spaces, create vibrant communities, and offer a glimpse into the future of urban living. As 2025 unfolds, we’re witnessing more than just buildings changing; we’re seeing cities evolving.

Heather Zeller

Heather Zeller, Vice President of Marketing at Veros Real Estate Solutions (Veros) and Valligent, brings over 25 years of expertise in marketing, product strategy, and corporate growth across financial services, real estate, and fintech. With a strong foundation in Marketing, Economics, and Business, she drives brand innovation and market leadership.