In the latter half of 2022, the housing market was characterized by low inventory and reduced affordability, primarily due to high prices and mortgage rates. Despite concerns of a crash, the market remained stable due to limited supply. Nationally, home prices decreased by an average of -0.63% from June 2022 to January 2023, but regional trends varied significantly, with the Pacific and Mountain regions experiencing larger declines (-4.5% and -4.2%, respectively) and the South Atlantic region recording a modest gain of 0.85% (Federal Housing Finance Agency – FHFA).

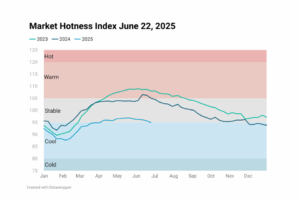

Looking ahead to the upcoming spring season, we can expect some recovery on average in both buyer and seller activity. However, this recovery will display distinct regional trends. Sellers have hesitated to give up their 3% mortgages, while buyers have been abstaining from the market due to a combination of factors, including high mortgage rates and persistently high home prices.

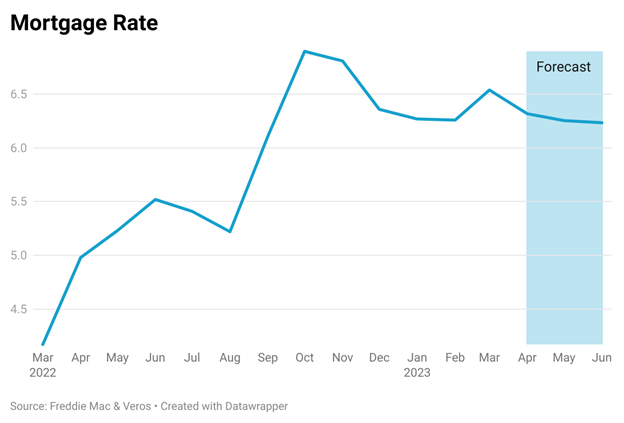

According to our projections, mortgage rates are expected to stay high, ranging from 6.0% to 6.5%, in the second quarter of 2023. Even at the higher rates, it is important to note that there was a surge in buyer activity in February, which coincided with a slight decrease in mortgage rates to around 6.1%. This indicates that potential homebuyers are highly responsive to changes in interest rates and are likely to react positively to more favorable borrowing conditions. Additionally, buyers are starting to accept higher mortgage rates as the new normal.

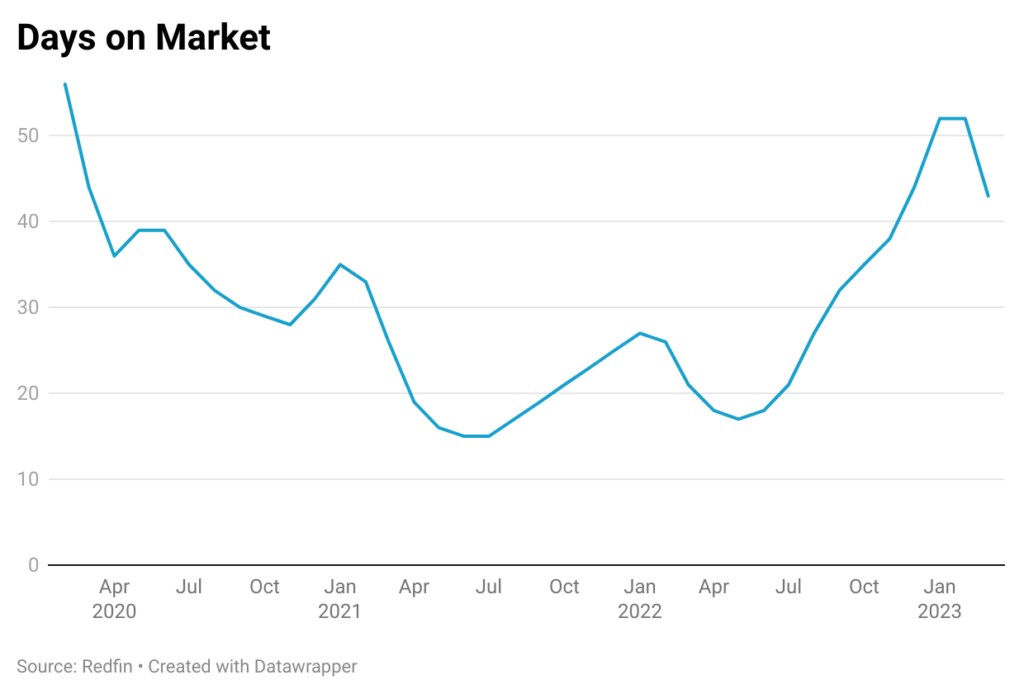

An important indicator that underscores the state of housing demand is the metric of days on the market. This quantitative measure exhibited a steady upward trend from May 2022 (17) to January 2023 (52) and then fell to 43 in March 2023. This implies that residential properties stay on the market for fewer days, which is indicative of improving buyer sentiment.

A persistent shortage of supply characterizes the current housing market. In March 2023, the average month’s supply for the U.S. was 1.9, down from 3.3 in January 2023. Although this figure has increased from the 1.3 level observed a year ago, it remains significantly lower than pre-pandemic levels. The scarcity of available housing inventory is evident from the number of existing homes for sale, which stood at only 980,000 in February 2023, compared to the 1,460,000 level recorded in February 2020. Moreover, the low unemployment rate and substantial homeowner equity have resulted in a low foreclosure rate.

Traditionally, the spring season is associated with a surge in housing market activity. However, the present scenario is marked by a discernible decline in the number of buyers and sellers compared to the preceding years. Multiple offers above the asking price are no longer received by sellers, who should be willing to list their homes at reasonable prices reflecting the state of the current market. On the other hand, buyers find themselves in a relatively advantageous position and are not under pressure to make an immediate decision to purchase a home. The competition among buyers in 2023 is less intense than in previous years. However, potential home buyers may find it difficult to time the market with respect to interest rates and cannot expect prices to fall significantly. Most forecasts predict that the housing market has bottomed out or is nearing its bottom. The housing market’s strength will depend on the extent of seller participation and the trajectory of interest rates. Market sentiment is picking up, as evidenced by the increase in the number of new listings, sales of pre-existing homes, and the proportion of pending sales. Nevertheless, the 2023 season is unlikely to replicate the heightened levels of activity experienced in 2021 and 2022.